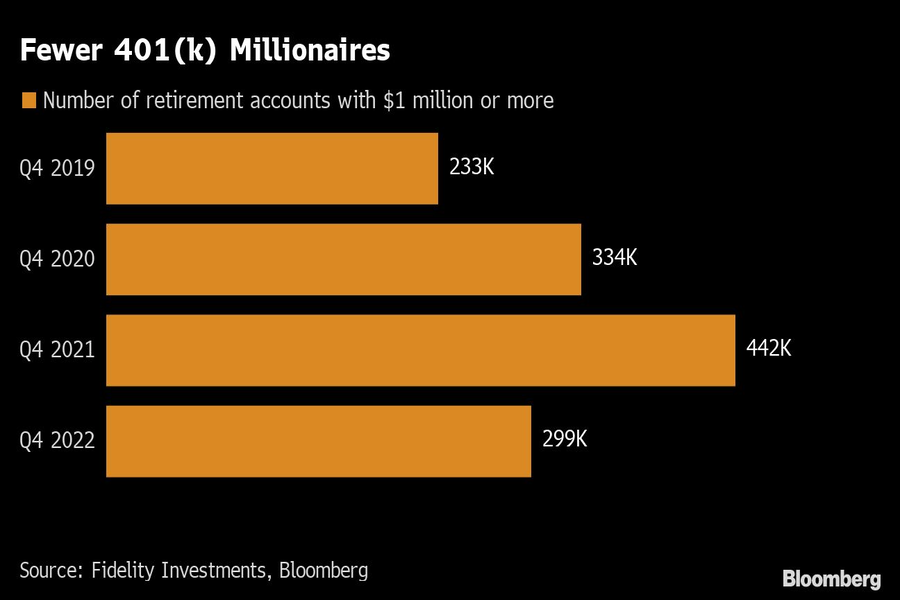

The 401(k) millionaire club has shrunk by a third.

Fidelity Investments had just 299,000 seven-figure workplace retirement accounts at the end of 2022, down from 442,000 a year prior, according to data from the asset manager.

The decline in million-dollar-plus savings came as the average 401(k) lost 20% of its value last year, hit by the slump in bonds and mega-cap tech stocks. The outlook isn’t much better for 2023, as investors continue to battle big headwinds from persistent inflation and continued economic uncertainty. Investors including Rob Arnott, co-founder of Research Affiliates, warn that the U.S. stock market “crash is far from finished.”

Investors may have multiple 401(k)s at Fidelity so it isn’t clear exactly how many individuals are represented in the diminished pool of accounts with at least $1 million. Most accounts are far, far smaller, with the average 401(k) account at Fidelity standing at $103,900 in 2022’s fourth quarter.

While many savers would be happy to have even that amount, one group of investors thinks far more is needed to achieve a comfortable retirement — the 553 people surveyed in Bloomberg’s latest MLIV Pulse survey said they’d need between $3 million and $5 million. About a third of investors pegged a comfortable retirement at $3 million, and roughly another third at $5 million.

Most respondents of the MLIV Pulse survey are optimistic they’ll move closer to their retirement goal by ending 2023 with more in retirement savings than at the end of 2022. Last year, inflation and rising borrowing costs hammered stocks, and since bond prices also plunged, the average U.S. 401(k) retirement account was down 20% at plans where Vanguard Group is a record keeper.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound