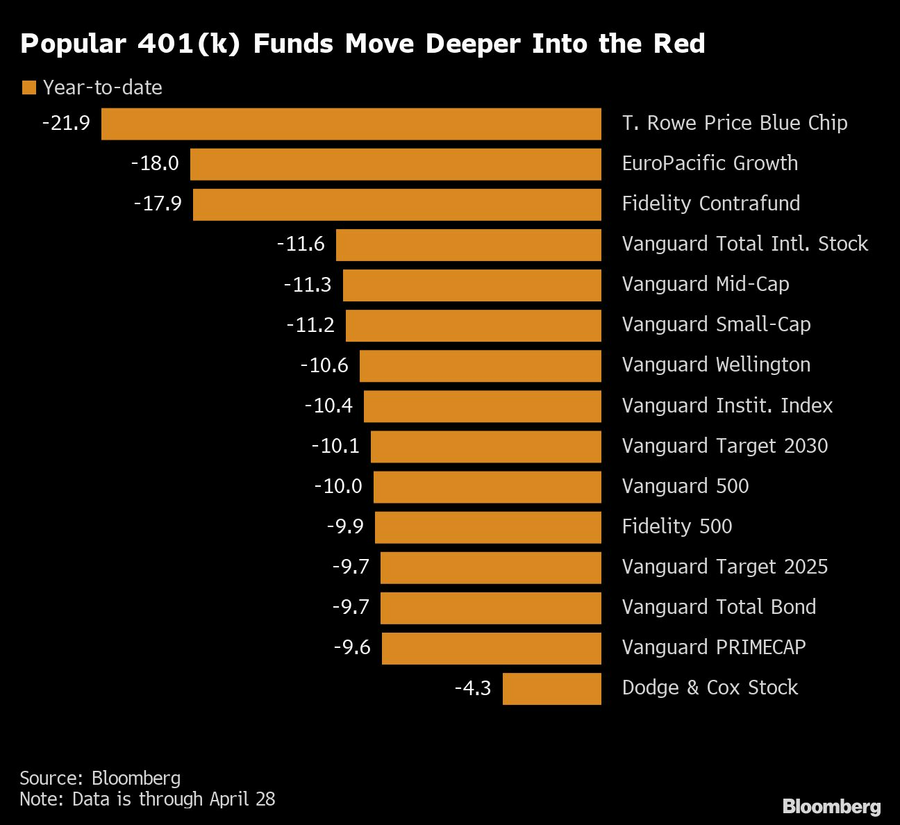

Anyone who dares peek at their 401(k) can see the carnage: Many popular funds in workplace retirement savings plans are down more than 10% so far this year. Some are even in, or approaching, bear market territory.

Many of the retirement funds are, unsurprisingly, growth-oriented and heavy on on mega-cap tech stocks such as Amazon.com Inc., which plunged Friday after the e-commerce giant reported a quarterly loss and said it may lose money again in the current period.

The epic bull run in mega-cap tech that began in March 2020 led many funds to become ever more concentrated in a handful of companies. The T. Rowe Price Blue Chip Growth fund, for example, held more than 46% of the fund in five stocks as of March 31 — Microsoft Corp. (11.6%), Amazon (10.9%), Alphabet Inc. (10.2%), Apple Inc. (8.7%) and Meta Platforms Inc. (5%) — and more than 60% of its assets in the top 10 stocks. The fund is now down almost 22% for the year.

Fidelity Contrafund, another big 401(k) plan favorite, held about 33% of the fund in its top five holdings as of Feb. 28, with Amazon its top stock, at 8%. Contrafund is now down almost 18% year-to-date.

The S&P 500 has lost more than 10% so far this year. While the recent volatility is gut-wrenching for many people nearing or in retirement, it’s an opportunity for millennial investors, said financial planner Thomas Kopelman, the 27-year-old co-founder of AllStreetWealth.

“For young people, the market going down is okay since you aren’t going to be using this money for a very long time,” Kopelman said. “So get the money in, and stop waiting for the perfect time to buy the dip.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound