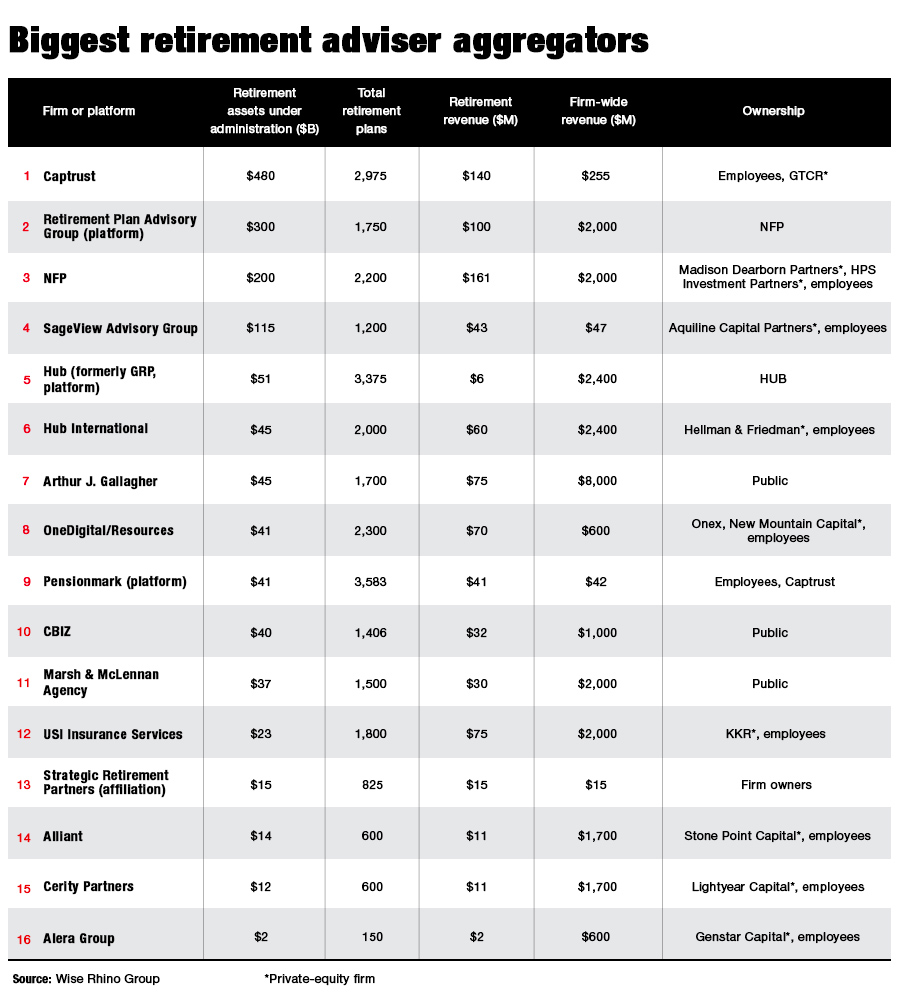

With Aquiline Capital Partners' purchase of a majority interest in SageView, the largest remaining independent defined-contribution aggregator, with almost $120 billion in DC assets under advisement, has fallen. With the SageView deal, a aggressive new buyer has entered the already frothy market for retirement plan adviser mergers and acquisitions.

What does the sale mean for RPAs and the entire DC market?

After private-equity partners lined up to invest in Captrust, which eventually selected GTCR, the firms that were left out were eager to invest. Big PE firms have little patience with buying smaller RPA firms – they prefer to deploy larger pools of capital. SageView became the most attractive option remaining, causing its valuation to rival that of the Captrust deal, which was rumored to be 20 times earnings before interest, taxes, depreciation and amortization.

With prices at an all-time high and feeling the need for capital, SageView founder and CEO Randy Long felt like the time was right. SageView had done only two deals in the past three years. The capital will be used to make acquisitions and invest in tools to leverage the convergence of wealth and retirement at the workplace.

“We selected Aquiline because they understand the financial services space. Unlike Captrust, we did not select the highest bidder,” Long said. Aquiline also has an interest in retirement plan record keeper Ascensus.

The RPA market is in the second of four phases of the consolidation curve, which is characterized by many deals. The record-keeping industry is in the third phase, which includes fewer but larger deals like the recent Empower Retirement acquisition of MassMutual’s defined-contribution business and Principal’s purchase of Wells Fargo’s retirement plan business. There are many buyers looking to acquire RPAs, with prices at an all-time high for those with at least $1 million in DC revenue and a premium for those with $3 million or more.

RPA firms are maturing from having been a cottage industry in the aughts, which makes them attractive to private equity, especially groups like SageView and Captrust. Those firms have grown through acquisitions, building the kind of platform needed to win larger DC plans and leverage the convergence by creating wealth management capabilities. Unlike Captrust, which earns close to 50% of its revenue from wealth, SageView has just $1 billion of personal wealth assets under management.

It may be hard for RPAs that resist record high offers and choose to remain independent to compete with these larger, well-capitalized aggregator firms. In the battle for the participant, RPAs need to pick a partner: either an aggregator; their broker-dealer, most of which have limited retirement assets and sensitivity; or a record keeper, which carries its own issues.

It’s critical for RPAs to pick the right partner for two reasons.

Though price is important, cultural fit may be more critical. If the deal must be unwound, RPAs not only lose the back end of the deal, which is becoming a larger part of the price, but they also have to spend years and precious resources to unwind it, and may never recover.

And as with the selection of record-keeper partners likely to win the consolidation wars, RPAs will want to select an aggregator likely to buy, not be bought.

Fred Barstein is founder and CEO of The Retirement Advisor University and The Plan Sponsor University. He is also a contributing editor for InvestmentNews’ RPA Convergence newsletter.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound