Fewer than one in five Americans can pass a basic financial literacy test, and that figure correlates strongly with a lack of saving and investing, results of a recent survey show.

About 19% of nearly 6,000 people surveyed in August could correctly define at least five out of seven simple financial terms, according to a report released Tuesday by consumer research firm Hearts & Wallets. Four of the terms were basic, including mutual fund, asset allocation, exchange-traded fund and cost basis. The remaining three questions were slightly more advanced, covering the definitions of passive investing and taxable brokerage account and the difference between traditional and Roth retirement accounts.

The results raise questions about financial education in the U.S. and whether workplace retirement savings plans can succeed in helping people make informed choices.

The default investment options for 401(k)s “should be strengthened and perhaps even required,” said Laura Varas, CEO of Hearts & Wallets. “Even me being a big fan of consumer choice, if you’re going to get into picking your own funds for something as important as saving for retirement, there ought to be some sort of a skill test.”

The way that companies describe their products and services to the investing public could also use an overhaul, she noted. Some, such as Acorns, describe passive investing in a way that consumers find more intuitive, the report found. That definition, which is essentially “buy and hold,” differs from a more technical descriptor, “investing in an index, often weighted to market capitalization.” The latter is used far more often, with companies such as Morgan Stanley, Morningstar, Vanguard, Fidelity and BlackRock describing it that way, according to the report.

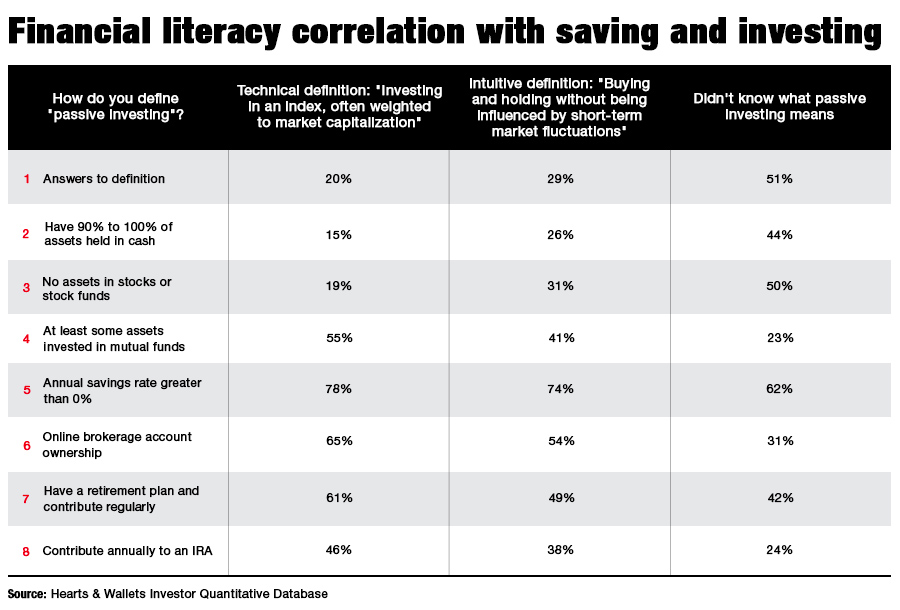

While more than half – 51% – of people said they have no idea what passive investing was, 29% gave a more intuitive definition and 20% gave the more correct, but technical, definition, Hearts & Wallets found.

“It’s not that the [plan] sponsors, the record keepers or the participants themselves need to do a better job. We need a Google translate for these words,” Varas said.

People who gave more technical and correct definitions for the different terms tended to have better saving and investing habits than those who gave intuitive but less precise answers, the report found. However, both of those groups were more likely than those who couldn’t identify the terms at all to have retirement accounts, invest in stocks and have positive savings habits.

“The alienating language has real repercussions for peoples’ finances. It’s important to get away from jargon and build solutions that don’t require them to understand this complex language,” Varas said. “Confusion about language holds people back from saving and using certain account types.”

There were some differences across generations and education and income levels related to how often people passed the quiz. People who work with financial advisers were also more likely to be familiar with basic financial terms, according to Hearts & Wallets.

While only 8% of high school graduates with no higher education correctly identified at least five terms, 22% of college graduates did so, and those with graduate or higher degrees did better, at 28%, the report found.

Across generations, millennials did worst, with 14% passing the test, followed by Gen Xers (19%), the silent generation (21%) and baby boomers (22%), according to Hearts & Wallets.

Having money also correlated with knowledge about financial terms. People with at least $2 million in assets passed the test most frequently, at 69%, versus 11% of those with less than $100,000 in investible assets.

Part of the way to address financial literacy “is teaching people the words, [but] the other of it is creating packaged products they can make choices about without having to learn a new, complex language,” Varas said.

For example, people should be able to decide whether they want a broad or detailed level of financial advice, not whether they should invest specifically in mutual funds versus ETFs, she noted.

“These are complex things -- they need complex words. We’re asking consumers to make choices about the wrong things,” she said.

There is a general lack of financial education in the U.S. A report published in October by the National Financial Educators Council found that about 40% of people turn to family, friends or co-workers for help understanding finances, while 36% use financial advisers and 24% do not have any assistance at all. That survey included responses from more than 1,200 people. A separate report from that group involving responses from more than 10,000 people found that the average score on a financial literacy test was 57%.

A 2017 academic paper published in the Quarterly Journal of Finance found correlations between education level and financial literacy. Authors Annamaria Lusardi, a professor at George Washington University, and Olivia Mitchell, professor at The Wharton School, found that financial literacy is also strongly linked with retirement planning.

“In all cases, we find that financial literacy is a key determinant of retirement planning, and that respondent financial literacy is higher when consumers were exposed to economics in school and in employer-sponsored programs,” the authors wrote. “We are cognizant of the fact that promoting financial literacy is a difficult and likely costly task … Yet it is also clear that ignoring widespread financial illiteracy is also problematic, particularly if consumers are to do a better job navigating the complexities of the modern financial environment.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound