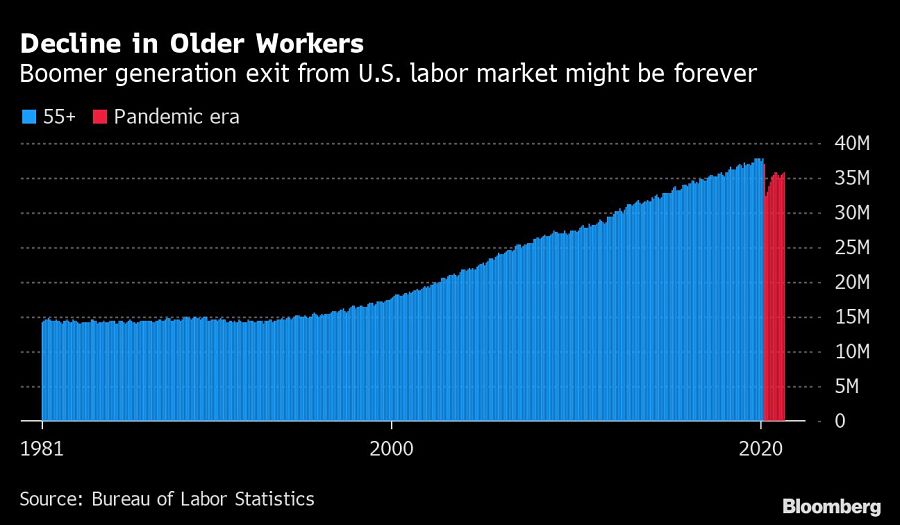

The surge in early retirements spurred by the pandemic is increasing inequality among baby boomers in the U.S., with older Black workers without a college degree more likely to be forced to exit the labor market prematurely, a study showed.

At least 1.7 million older workers retired early because of the pandemic crisis, according to a report by the New School for Social Research’s Retirement Equity Lab.

The Covid-19 health crisis is creating two classes of early retirees. People who have investments are taking advantage of the unprecedented surge in shares and home values to enjoy their silver years.

Meanwhile, many low-paid workers without much retirement savings found themselves forced out of their jobs with little prospect of finding employment again. Retiring before the full retirement age will result in a cut in their Social Security benefits, by as much as 30%.

The few years before 65 are crucial to prepare for retirement, and unplanned exits can lead to downward mobility and even poverty for these workers, said Teresa Ghilarducci, economist and director of the Retirement Equity Lab.

“The pandemic is revealing the main fault line in our broken retirement system -- inequality,” said Ghilarducci, who’s also a Bloomberg Opinion contributor.

Workers age 55 to 64 without a college degree retired at a 5% faster pace during the pandemic, while retirement for that age group with a college education declined by 4%, according to the Retirement Equity Lab report. At older ages, over 65, college degree holders were more likely to exit the labor market than pre-Covid, however.

Black workers without a college degree experienced the highest increase in retirement rate before age 65, jumping from 16.4% to 17.9% between 2019 and 2021, the data show.

The researchers found that older workers without a college degree had median household retirement savings of only $9,000 in 2019, compared with $167,000 for those with a college degree.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound