The bulls are running. The bears are retreating. And investors are once again dreaming about early retirement. The question is, should their advisors be waking them up?

That’s a tough one, and it requires the review of a bit of not-so-distant history.

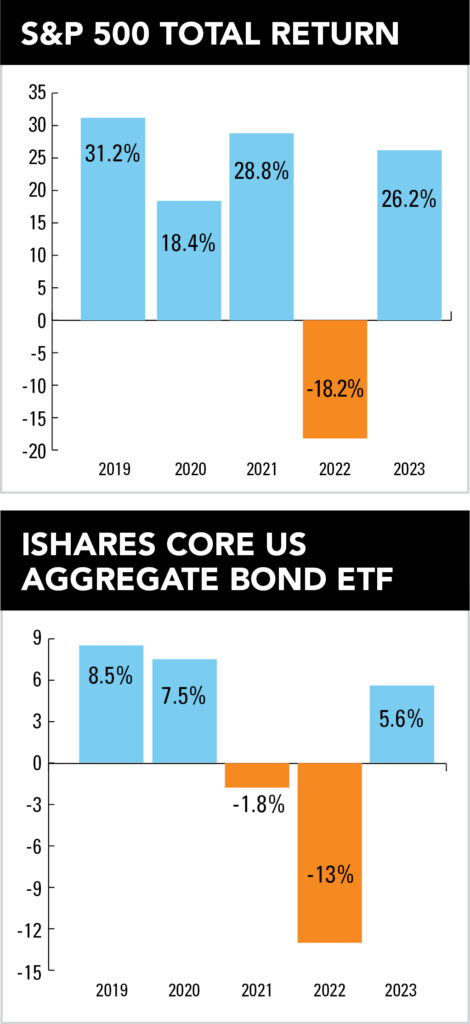

From 2019 through 2021, the stock market posted luscious back-to-back-to-back returns of 31 percent, 18 percent, and 29 percent, respectively. Client accounts grew so bountiful in the wake of that three-year stretch that workers approaching retirement at the time could practically taste it.

Meanwhile, over the same three-year span, the iShares US Aggregate Bond ETF (AGG) went on a decent run of its own, returning 8.5 percent in 2019 and 7.5 percent in 2020, before posting a slight drop of 1.7 percent in 2021.

Even gold shined for most of those three years, with the yellow metal returning 18 percent in 2019, 25 percent in 2020, and a negative 4 percent in 2021.

Seriously, with all that bullishness raging across nearly every asset class at the time, it’s hard to blame a long-serving employee for shopping for a hammock or Winnebago while on the job.

And then came 2022, and those daydreams went poof! The S&P 500 sank 18 percent, while the AGG dropped 13 percent. Even gold slid almost a percentage point despite all the financial turmoil. The only asset class that seemed to work during that turbulent year was private market alternatives, and only because they didn’t have to be marked to market.

Fast forward back to the present, and the S&P 500 and gold are hitting new highs after bouncing back in 2023, when they were up 26 percent and 12.7 percent, respectively. Meanwhile, bonds are behaving once again as they are supposed to, with the AGG up 5.6 percent last year and now yielding over 3 percent.

With all this bullishness in mind, what are advisors telling clients who may once again be daydreaming of an earlier-than-expected retirement?

In the Bible, Joseph interprets Pharaoh’s troublesome dream by telling him there will be seven years of abundant harvests followed by seven years of famine. Taking Joseph’s agricultural forecast to heart, Phaaroh stocks up on grain during the good times, eventually using it to successfully tide his country over during the subsequent tough times. As a result, Pharaoh makes Joseph his full-time advisor and gives him a bigger slice of his portfolio to manage.

Christopher Davis, partner at Hudson Value Partners, takes an approach similar to that of Joseph by socking away some additional funds during boom times to make sure his clients are covered during the lean ones.

“We almost always seek to set aside one to two years of distribution needs in cash and short-term fixed income for clients,” he said. “New highs are a good time to top those levels up, but by having this buffer, we seek to mitigate sequence-of-returns risk and having to sell at inopportune times. Knowing the funds are there makes it easier to stay the course on your asset allocation.”

Davis is also using this run-up to rebalance client portfolios back to their target weights, as the concentration of returns has been even narrower so far in 2024 than in 2023. In recent months, he’s been taking the profits off the top of some of his successful investments that have become overgrown to find and fund opportunities in areas such as Japanese equities, health care, and small- to mid-cap industrials.

“It’s important to balance finding those companies who are growing their fundamental earnings power with how much you are paying for those earnings,” he said. “Your entry price is the one thing about an investment that cannot improve with time.”

Matt Kilgroe, CEO of Cyndeo Wealth Partners, agreed that an extremely strong or weak market would potentially propel him to rebalance more often than he would otherwise. Nevertheless, he emphasized that a powerful bull run – or bear raid – shouldn’t change the plan itself.

“Timing the market is not a good retirement plan, so our base percentages of equity in retirement plans don’t change,” he said.

Perhaps nodding to King Solomon’s wisdom of splitting the baby in half, Barbara Pietrangelo, financial planner at Prudential Advisors, focuses more on the short term, making sure her clients have enough income to pay their regular bills. Once that mission is accomplished, she creates longer-term asset allocations for them that can weather future booms or busts.

“While the market generally goes up over time, no one can accurately predict what will happen. Everyone’s situation is so unique, so we start with understanding the clients’ goals, needs, risk tolerance, and then create a plan. While we may need to tweak it from time to time, the core components remain the same,” Pietrangelo said.

One of advisors’ biggest reactions to the 2022 meltdown was the rush to add alternatives to client portfolios. The classic 60/40 mix of publicly traded stocks and bonds fell 16 percent that year, suffering its worst performance since the global financial crisis in 2008. Wealth managers turned to private markets to help weather the storm, with many proclaiming the 60/40 a thing of the past.

Alas, rumors of the demise of the 60/40 portfolio proved premature. According to Morningstar, a standard balanced portfolio combining a 60 percent weighting in the Morningstar US Market Index and a 40 percent weighting in the Morningstar US Core Bond Index returned a more than healthy 18 percent in 2023.

So now that the public markets are once again showing their muscle, what, if anything, should advisors do with all those far less liquid private investments they added to asset allocations when things were looking bleak?

Kilgroe said he has no plans to eliminate alternatives from the mix. If anything, he said, rebalancing out of stocks could likely mean an increase in private investments for his clients, although he remains wary of real estate due to interest-rate pressures on commercial buildings.

“Private credit particularly is attractive to us given the yield differential versus traditional fixed income,” he said. “There are other considerations around private credit such as liquidity, but in the right proportions we like the asset class.”

Likewise, Michael Leverty, founder and CEO of Leverty Financial Group, said he adjusted his equity allocation by increasing his exposure to private equity. In his view, the strategic shift reflects recognition of the ongoing trend of companies choosing to remain private.

“While acknowledging the reduced liquidity inherent in private investments, we believe that the benefits of diversification and potential for enhanced returns outweigh this concern,” he said.

Leverty added that he’s also upping his allocation to private credit in the fixed-income portion of his portfolio. “We are particularly drawn to the first lien and floating-rate characteristics inherent in this sector.”

Stock funds weren’t the only retirement savings vehicles flying off the shelves last year. The US annuity market also set a new record. According to Limra, total sales of annuities in the US surged to $385 billion, up from $310.6 billion in 2022, when fear drove investors out of stocks and into guaranteed annuity contracts.

Now that stocks and bonds are safe again, or at least “safer,” should advisors put them back on the metaphorical shelf?

“The guarantee that annuities provide can be very valuable to the peace of mind of some clients. But that guarantee is a lot more costly than owning the genuine articles of stocks and bonds directly,” Davis said.

In his view, if a wealth manager can get the asset allocation right and create a financial plan that the client is comfortable with, then annuities become less relevant.

Kilgroe is also not a fan of annuities, no matter the market. He believes Social Security, and in some cases pensions, act as great supplements to a well-designed retirement plan. However, he sees the fixed-income portion of a 60/40 strategy as a better way to create income for clients.

“The idea of guaranteed income is comforting, but the expense and lack of flexibility around annuities is something we don’t find attractive,” Kilgroe said.

Prudential’s Pietrangelo has been using equity products with “buffers” as a cheaper alternative to annuities. These products allow clients to get a portion of the upside and limit losses if markets go down.

“I’m finding clients nearing or in retirement are attracted to different approaches to protecting their money and seeing growth in their nest eggs, which took them so long to accumulate,” she said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound