This month's edition kicks off with the big news that AssetMark has acquired UK financial planning software provider Voyant for $145 million, with plans to bring the planning software as a new competitor to the U.S. (in addition to likely integrating it deeply into AssetMark’s own technology stack)The deal highlights both the ongoing rise of financial planning, the dearth of new financial planning competitors with enough market share for strategic acquirers, and the reality that financial planning software continues to be an appealing synergistic value-add not only to investment-centric firms offering financial planning but also asset managers and TAMPs trying to expand into working with more planning-centric advisers.

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

Read the analysis of these announcements in this month's column, as well as discussions of more trends in adviser technology:

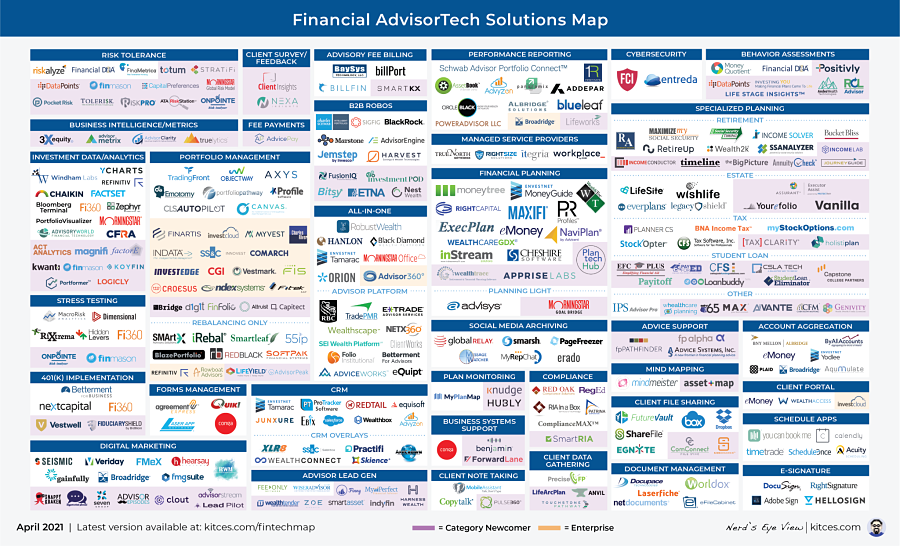

Be certain to read to the end, where we have provided an update to our popular “Financial AdviserTech Solutions Map” as well!

#AdviserTech companies who want their tech announcements considered for future issues should submit to TechNews@kitces.com!

AssetMark acquires UK financial planning software Voyant for $145 million as TAMPs hone in on planning-centric future. From its earliest days more than 50 years ago, financial planning has long been recognized as something that helps drive clients to take action; after all, relative to the traditional product-based approach of selling features and benefits, financial planning starts with an understanding of clients' needs and goals and drives toward crafting recommendations that will help them achieve their goals, the very essence of a consultative-selling approach. Over the years (and especially in the last decade), the growth of financial planning has led to the rise of various “fee-for-service” business models where financial advisers are paid directly in the form of hourly, project, subscription or retainer fees for the advice they provide. Nonetheless, the bulk of financial planning is still delivered under the aegis of investment management (where financial planning is a value-add that is paired with investment management to form a more holistic wealth management offering). That means as outsourced investment management via various TAMPs becomes more popular as a way to implement investment portfolios for clients, asset managers and investment providers are increasingly acquiring financial planning software providers, from Fidelity buying eMoney Advisor, Orion acquiring Advizr and Envestnet acquiring FinanceLogix and then MoneyGuidePro. So it comes as no great surprise that AssetMark, the third-largest TAMP provider (behind Envestnet and SEI) this month announced the acquisition of Voyant, one of the leading financial planning software providers in the UK. The acquisition will allow AssetMark to embed financial planning software more deeply into its own TAMP platform to formulate a more all-in-one integrated solution. However, AssetMark has thus far pledged to maintain integrations with third-party planning software providers as well, and moreover has indicated that it plans to offer Voyant independently in the U.S. as well, mixing up the current competitive landscape of financial planning software with a new goals-based planning tool (that has a strong reputation for its timeline-based approach of illustrating how clients' near- and long-term goals will change with various trade-off decisions regarding how they save and spend). Of course, advisers who adopt AssetMark’s Voyant will also become prospects for AssetMark’s broader TAMP services (and what will ostensibly be deeper integrations from Voyant to AssetMark’s own platform in the future), and AssetMark also notes that the acquisition gives it a base of UK (and Irish and Canadian) advisers who currently use Voyant and might be cross-sold AssetMark’s TAMP services in new markets, as AdviserTech tools increasingly becomea distribution channel for asset managers. Of greatest surprise to many in the AssetMark deal, though, was simply that the company chose to go outside the U.S. and not buy an existing incumbent that already has substantial U.S. market share (e.g., Advicent’s NaviPlan or RightCapital). Though in the end, with so few financial planning software players left unacquired (at least among those who already have a material market share), AssetMark’s deal arguably signals both the extent to which there is still more demand for financial planning software (that AssetMark would spend $145 million on a non-U.S. provider to gain a more competitive position inthe U.S.!) and the opportunities that remain for the next generation of financial planning software providers that can figure out how to compete for the next generation of advisers and clients.

Orion acquires Hidden Levers as portfolio stress testing becomes an enterprise risk management tool. While financial advisers have long had to live with the volatility of markets — both in counseling clients through bear markets and dealing with the impact on their own advisory firms when investors potentially panic-sell or at least hide their heads in the sand when markets swing wildly — the reality is that the ongoing industrywide shift to the AUM model, coupled with a decade-long bull market, means the AUM of the average advisory firm has never been higher … and the consequences of a market pullback have never been more dangerous for the average advisory firm. After all, when the market fell nearly 37% from top to bottom in the span of barely 6 weeks (the fastest 30%-plus sell-off ever), and even balanced portfolios were down nearly 20%, the typical advisory firm with a 20-something-percent profit margin faced the risk of having profits go all the way to zero … such that any further market decline could even necessitate layoffs. While in theory most advisory firms know that markets go in cycles and that bear markets are inevitable, few had any clear understanding of their real revenue risk, and how a market decline leading to an AUM decline would result in a revenue decline, especially for a firm with multiple advisers who each have dozens of clients that use multiple different portfolio models with varying levels of risk exposure. Even though “portfolio stress testing” has long been a category on the AdviserTech landscape map, in practice the key players like Rixtrema and MacroRisk Analytics have been more focused on using the technology to stress-test the client’s portfolio either to optimize how it’s diversified (against various market stress scenarios) or as a sales proposal tool to highlight how a prospect’s existing portfolio is at risk in various stress-test scenarios (that the adviser’s recommended portfolio will better solve for). In the realm of portfolio stress testing, though, Hidden Levers was unique in announcing back in 2019 a partnership with RIA aggregator Focus Financial to provide enterprise-level analytics of a firm’s revenue exposure, applying the stress-testing approach not to evaluate just the client’s portfolio risk but also the advisory firm’srevenue exposure (and highlight focused areas of risk within a particular segment of clients, subset of advisers or particular branch office location). Now Orion Advisor Services announced that it has acquired Hidden Levers, bringing the Hidden Levers enterprise risk capabilities to the entire Orion user base of advisory firms (which skews toward larger independent RIAs that would be the best fit for Hidden Levers’ enterprise risk analytics). In addition, of course, Orion gets the entire Hidden Levers platform, which extends Orion’s capabilities in portfolio risk analysis and can function as a risk-based sales proposal generation tool to compete with the likes of Riskalyze (both for Orion’s existing user base, and to the advisers that use its Orion Communities model marketplace and its Orion Portfolio Solutions TAMP offering (including the recently acquired Brinker Capital). All of which positions the Orion-Hidden Levers deal as a big win for both Orion and Hidden Levers — and the broader AdviserTech community, as Hidden Levers becomes another success story of a homegrown, bootstrapped AdviserTech solution that developed a strong product, gained traction in the (independent) adviser community, and resulted in a successful acquisition as an inspiration for other AdviserTech founders in the future.

Tifin Group acquires Totum Risk and MyFinancial Answers in shift from fintech incubator to platform integrator? The traditional venture capital approach to investing in startups usually focuses on trying to find the next unicorn, one that may be tiny today but is capable of growing to someday be a $1 billion-plus enterprise … an endeavor that is still so difficult that success was named after a rare mythical animal. The challenge of this approach when it comes to the world of AdviserTech, in particular, is that in practice, the marketplace is so fragmented and there are only so many advisers in the total addressable market, that it’s even harder to find a company that ever couldbecome such a unicorn. That in practice has limited the flow of venture capital dollars into the AdviserTech domain. Yet the irony is that the failure rate on attempted unicorns is so high that it arguably compounds the problem; after all, if the overwhelming number of attempts to find the next unicorn are likely to fail, the investor musttry to find one that willbe the next unicorn to offset the losses of all the rest that don’t work out. The alternative approach, though, is not to speculatively invest into a slew of companies hoping that one hits it big, but to nurture a portfolio of companies, all of which can at least be moderately successful, such that in the aggregate a steady stream of singles and doubles obviates the need to always swing big hoping to hit the next home run. In the AdviserTech context, a case-in-point example is Tifin Group, which has incubated, acquired, or built its way to more than half a dozen different fintech companies, including investment analytics provider Magnifi, financial personality assessment tool Positivly, content marketing platform Clout and the (recently sold to JP Morgan) tax-sensitive rebalancer 55IP, by offering centralized developer and consulting resources to multiple fintech founders to help power their collective growth. In March, Tifin Group announced two new additions to its portfolio of incubated companies — Totum Risk, which provides risk tolerance software, and MyFinancialAnswers, which had built consumer-facing financial planning tools originally used in the employer financial wellness channel. Given the immense popularity of both risk tolerance and financial planning software these days, it’s straightforward to see how Tifin hopes that by acquiring and doing some level of reengineering of the software and refocusing of its target market and distribution, there’s an opportunity to build the companies to the next level through a financially profitable growth cycle and exit to a strategic acquirer (just as JPMorgan acquired 55IP). However, with the addition of financial planning and risk tolerance tools to its existing suite (which includes marketing through Clout and investment research through Magnifi), Tifin also appears to be positioning its portfolio of companies toward something that may become a more integrated whole in addition to the modular component parts. Ongoing frustrations with the limitations of AdviserTech integrations and the fact that even midsize adviser enterprises often do not have their own dedicated technology team and developer resources are leading to a growing hunger for more all-in-one” solutions as well. Ultimately, though, the challenge remains that all-in-one platforms — particularly those that would have to lay on top of an existing adviser platform (e.g., a broker-dealer or RIA custodian) — often have an even more uphill battle to convince advisory firms and enterprises tobuy everything at once (instead of just slotting in the best-in-class solutions they need to fill a particular gap). Either way, though, Tifin’s incubator-style approach to developing new AdviserTech tools — in a world where most of the successful tools already came about as homegrown, bootstrapped solutions — is a welcome addition to support innovation in the world of AdviserTech, and its successful exit of 55IP will likely open the door to more opportunities to acquire and nurture AdviserTech firms in the years to come.

Envestnet acquires Apprise as technology to feed its trust services exchange. Plaid was launched in 2013 as a money management tool that built its own data aggregation capabilities (to power those money management insights) but ultimately found there was even more value in leveraging those account aggregation data flows to power API-driven actions for other fintech firms. Sensing the opportunities in account aggregation to power financial planning — including what at the time was an eye-popping acquisition price for eMoney Advisor when Fidelity acquired its financial planning software with account aggregation capabilities in 2015 — Envestnet acquired Plaid competitor (and one of the original account aggregation platforms) Yodlee later in 2015 for a stunning $590 million. Yet now, more than 5 years later, Plaid has experienced a meteoric rise, seeing valuations up to $13 billion, more than three times that of Envestnet’s market cap, despite the fact that Envestnet is doing nearly $1 billion per year in revenue to Plaid’s $200 million. However, while Yodlee is not as sexy as Plaid, and the architecture may not be as modern, it certainly still has the potential to be the foundation of a similar vision and strategy as Plaid, which is about going beyond the raw data of account aggregation to power actions in financial services. After all, as software eats the world, finance is being embedded in the world-eating monster. Everything is becoming a fintech company in some way, shape, or form. Uber is issuing credit cards now, Peleton offers financing and payments are embedded everywhere. In Envestnet’s context, the vision centers on CEO Crager’s intelligent financial life vision, in which Envestnet’s Yodlee-powered account aggregation client Personal Financial Management (PFM) portal not only connects to and facilitates a financial planning experience, but extends to Envestnet’s ever-growing series of Exchanges that facilitate various financial services product transactions. In this context, it’s notable that in March, Envestnet announced that it has acquired Apprise Labs, which was originally a joint venture between Envestnet, MoneyGuide, and former eMoney Advisor founder Edmond Walters to build a next-generation estate planning tool for ultra-high-net-worth clients. The consummation of the deal itself will add a new depth of estate planning capabilities to Envestnet’s suite of offerings … recognizing that Envestnet doesn’t need multiple planning offerings, so those core Apprise estate planning capabilities will be folded into MoneyGuide as a new Wealth Studios module. From the perspective of Envestnet’s broader business model, though, the reality is that it was just in February that Envestnet announced the launch of its new Trust Services Exchange, which will allow RIAs and broker-dealers to gain access to a marketplace of trust services providers for their HNW clients (for which Envestnet will earn a small scrape as the distributor in a classic platform model). That means Envestnet suddenly owns a new next-generation estate planning software platform for ultra-HNW clients, just as it’s launched a new Trust Services Exchange for ultra-HNW clients. That could easily be prompted where appropriate from directly within the new Wealth Studios, just as MoneyGuide is being positioned to identify annuity and insurance opportunities within its financial planning software that queues up directly to Envestnet’s Annuity/Insurance Exchange. In other words, the launch of Envestnet’s Trust Services, paired with the acquisition of Apprise, is simply another step forward in Envestnet’s broader platform of platforms model, in which more and more product implementation opportunities can be embedded into its ever-widening range of capabilities, like a giant app store of financial services products. Want a managed accounts platform? Flip this switch. Want a new insurance or annuity policy? Flip this switch. Want trust services? Flip this switch. Want trading and rebalancing? Flip this switch. Want lending? Flip this switch. It doesn’t even have to stop at traditional wealth management offerings, as Envestnet can expand horizontally into other financial services verticals, powered by the ever-widening reach of its holistic financial wellness platform. At the base level, Apprise has built a core piece of estate planning infrastructure for that vision of tomorrow, as estate planning is and will always be a critical piece of the wealth puzzle for ultra-HNW clients. This, along with the incredible Apprise user experience, was the reason for the acquisition. But from a broader perspective, fintech software isn’t the end product anymore; it’s the distribution channel and the pathway to Envestnet’s growing breadth of exchanges, and Apprise was simply the next piece of the software puzzle to match to the next Envestnet exchange.

Invesco consolidates its AdviserTech acquisitions under Intelliflo to leverage AdviserTech distribution (globally?). When BlackRock acquired FutureAdvisor in 2015, it spawned the realization that robo-advisers weren’t necessarily a competitor to financial advisers; instead, the technology represented a distribution channel for asset managers, through which they could distribute their funds to advisers by providing them the technology they need to run their businesses (and keep the asset manager’s funds handy as a solution). Yet while some asset managers, like BlackRock, have had substantial success with the approach, others like Invesco — which over the years acquired robo tool Jemstep, portfolio rebalancers RedBlack and Portfolio Pathways, and more — have struggled to gain significant traction with the approach. So now Invesco, the issuer of the beloved QQQ ETF, has combined the five software companies it has acquired into one brand, Intelliflo; Jemstep becomes Intelliflo Office (for its digital onboarding), Portfolio Pathway becomes Intelliflo Portfolio (for portfolio management), RedBlack becomes an Intelliflo solution for rebalancing and model management, and i4C (a UK financial planning software solution) becomes Intelliflo Planning. That effectively unifies the Invesco offerings into a single comprehensive solution for financial planning, portfolio management and digital onboarding for advisers and their clients. In other words, while RedBlack, Portfolio Pathway, Jemstep, Intelliflo UK and i4C individually may have had some nice businesses, none of them were exactly setting the world on fire with growth. Invesco seems to be betting on the sum being greater than the parts, where the underlying technology of these five companies was good, but combined under Invesco they will have the marketing and distribution chops to grow into behemoths. At this point, though, the question is whether Invesco will focus its new offering. On the one hand, it could be an appealing offering as a central management system for RIAs, though custodians are increasingly offering their own digital onboarding and portfolio management capabilities. Invesco could also use the Intelliflo solution to compete more directly against Envestnet by selling it as an operating system to independent broker-dealers, with the ability to subsidize the cost of the software by generating flows to its asset management solutions. Or, given that the Intelliflo Planning hub isn’t even fully available yet in the U.S., Invesco may actually see its greatest opportunity to (re-)deploy Intelliflo abroad, taking the BlackRock AdviserTech-as-distribution-channel approach to other countries where Invesco has a toehold but less competition. Either way, though, the name of the new offering says it all: Invesco seems to have positioned Intelliflo as an intelligent way to try to create new asset flows into Invesco.

Bluff Point acquires True North Networks as IT managed service providers become the next RIA services roll-up? One of the most dramatic trends in the financial adviser world over the past 10 years has been the introduction of private equity investors to advisory firms, particularly the independent RIA channel and its recurring-revenue AUM model. In fact, private-equity-funded deals — from outright PE acquisitions to PE-funded RIA aggregators, and PE firms funding “sub-acquisitions” by their portfolio companies — now account for the majority of RIA transactions. The end result is that there is so much investor capital chasing only a limited number of firms for sale that the lack of supply relative to demand continues to drive RIA valuations higher and higher. That the shortage of outright RIA firms available for sale means PE investors are now beginning to spill over into acquiring service providers that support the RIA ecosystem as an indirect play instead, from Aquiline acquiring RIA In A Box to numerous RIA-centric AdviserTech acquisitions. Accordingly, in March came the news that private equity firm Bluff Point Associates has acquired True North Networks, which competes in the realm of managed service providers that offer outsourced IT support and infrastructure with a focus on independent RIAs. It’s an increasingly popular solution both as RIAs grow (large enough that they need IT support for their growing teams but not so large that they can afford a full-time IT staff member) and as they face a growing volume of cybersecurity threats that necessitate having a strong IT infrastructure. Notably, the news followed the announcement last fall that Bluff Points’ cloud solution provider Swizznet had acquired True North Networks’ competitor Rightsize Solutions, marking what appears to be a full-scale roll-up effort involving managed service providers for RIAs, and raising the question of whether other MSPs for RIAs like Itegria and OS33 and FCI may be next. After all, the typically $100-to-$200 a month per user pricing for outsourced IT solutions yields a strong and steady revenue stream to providers (and the investors who want to acquire them), and the ongoing growth of the RIA channel in terms of both the number of firms and the average size of firms provides a structural tailwind in favor of the demand for IT managed service providers (especially in such a highly regulated industry). All of which means the Bluff Point acquisition of True North is likely not the end of the consolidation of MSPs for RIAs … and a potential sign of a broader growing trend as PE firms seek out more other ways to participate in the ongoing growth of the RIA channel than just trying to find the few independent RIAs remaining that haven’t already been sold but might be in the coming years.

Skience launches new data tools as advisory firms increasingly warehouse their own data. The good news about the rise of the internet and the availability of APIs is that the ability to pass data from one application to another allowed integrations between otherwise independent adviser technology platforms to proliferate over the past decade. The bad news, though, is that the lack of any data standards within the broader world of AdviserTech means creating integrations — and figuring out how to handle disparate types of data from various sources (or even similar types of data that are handled in different ways from different sources) — makes it difficult for many integrations to go as deep as they ideally would and could. And while many efforts have been initiated over the years to attempt to create more consistent data standards, in practice, adviser data standardization has not materialized. Instead, it’s typically the major adviser platforms themselves — various RIA custodians, major broker-dealers and key players in the AdviserTech ecosystem — that tend to dictate standards for the data that pass through their platforms (and for all the advisers on that platform). However, the ongoing growth and scaling of advisory firms themselves, as the AUM model continues to compound ever-larger firms, is leading to an emerging movement among at least the largest advisory firms to take back control of their data, building their own data warehouses to manage their data and send it back into their various CRM, portfolio management and other AdviserTech tools. In practice, the overwhelming majority of advisory firms don’t have the technical depth and capability to build their own data warehouses, which is leading to an emerging category of data warehousing and management tools for advisers (e.g., the recent launch of MileMarker). In February, Salesforce CRM overlay provider Skience announced a new Data Consolidation module to help pull in advisory firm data from dozens of sources, house that data and then push it into Salesforce (which can then do everything from powering Business Intelligence to advisory firm workflows, or be subsequently passed through to other parts of the AdviserTech stack that integrate with Salesforce). Notably, though, the significance of solutions like Skience’s new Data Consolidation tool is not merely the potential to produce more usable data by having a central platform through which it can be scrubbed and standardized for an advisory firm (and then passed into the tools that it uses), but also that when advisers have more control of their data, they become more independent from existing adviser platforms that in practice often retain advisers in part because the advisory firm doesn’t want to face the data loss (or cumbersome data migration) that would occur by switching platforms. All of that is solved with the rise of advisers more independently warehousing their own data. Though of course, when data warehousing is itself still facilitated by a third-party provider (i.e., Skience), advisers still run the risk of being beholden to a single platform for their data management needs. Nonetheless, given the breadth of Salesforce’s utility (to integrate with so many other tools and platforms), and the ongoing emergence of the CRM system asthe new adviser hub itself, arguably Skience is very well-positioned to convince advisers that warehousing data alongside a third-party CRM system still allows for more independence and flexibility than the platforms that keep advisers beholden by holding their data today.

Pershing beta-tests new digital repapering tool to make broker-dealer breakaways painless. When financial advisers want to make a switch from one investment platform to another (whether from one broker-dealer to another, one RIA custodian to another or breaking away from a broker-dealer to the RIA channel), one of the biggest inhibitors is the dreaded repapering process of opening new accounts and facilitating transfers for each and every client from their old accounts at the prior platform to their new accounts on the new platform. In some cases, the fear of repapering is driven by the concern that clients who may not be entirely thrilled with the adviser’s services were satisfied enough to stay, but won’t necessarily be willing to sign the paperwork to make a switch, which means the act of repapering results in the termination of some marginally attached clients. In other cases, the risk is simply that the client won’t be willing to change platforms, either because they liked the old platform’s client experience more than the new one, they trusted the old platform’s brand more than the new one, or because they just don’t want to deal with the hassle of updating their own account logins and other tools they had integrated to those accounts (e.g., Mint.com). Though most commonly, advisory firms balk at switching platforms and repapering simply because of the sheer amount of time and work it takes torepaper an entire base of clients. If a sizable firm has several hundred clients, each of whom has several accounts each, and it takes 30 to 60 minutes per client to prepare the new account form and the associated transfer forms, send it out to the client for signatures, and collect the forms back to submit and process, the act of switching platforms can amount to 1,000-plus hours of labor and tens of thousands of dollars in staff costs (not to mention the sheer complexity of managing the scope of the project to ensure nothing goes wrong for clients along the way). In this context, it is notable that last month Pershing announced that it is starting a beta test of a new digital repapering solution, in which the adviser provides a list of client emails, and Pershing emails them directly to enter their login credentials to non-Pershing accounts, after which Pershing will screen-scrape the pertinent information directly from their account to prepopulate Pershing forms (and ostensibly to queue them up immediately and automatically for e-signature). That has the potential to save literally hundredsof hours during the repapering process for advisers who are switching RIA custodians or breaking away from a broker-dealer to Pershing (as even with some tracking and client follow-up, simply eliminating the paper of repapering is a verymaterial lift), greatly greasing the breakaway broker wheels in a world where inertia and the fear of repapering friction are still among the biggest blocking points to advisers going independent. (Not to mention that the repapering solution would put Pershing at a competitive advantage with breakaways relative to other adviser platforms that would still otherwise require a more manual labor-intensive repapering process.)

AdvicePay rolls out mobile deposits for financial planning checks to eliminate overnight postage fees. Under SEC Rule 15c3-3, broker-dealer enterprises must “promptly transmit” funds received in connection with its activities as a broker-dealer, which in practice means any checks that an adviser receives must be promptly forwarded to the home office (typically by noon of the next business day as an overnight or priority mail package). Because most broker-dealer branch offices only have a limited number of advisers and receive a limited number of checks (if any) on any particular day, in practice, the end result of the prompt-transmission requirement for checks is that a lot of advisers spend $10 to $20-plus per check to send them as quick as possible to the home office (as it’s not even permitted to wait until the end of the week to batch the sending of checks together). Writ large across a sizable broker-dealer enterprise with dozens of branches and hundreds of advisers, the end result can be a postage bill that amounts to tens of thousands of dollars that is simply attributed as “the cost of doing business.” On the plus side, when each check from a client may represent tens or hundreds of thousands of dollars (or more) in deposits to their investment accounts, postage fees are still a good deal to win the client’s business, and most firms are at least gently trying to encourage their advisers to transfer funds directly from one bank or brokerage account to another via wire or ACH transfer (or as part of the ACATS system). But when it comes to providing advice services and receiving a financial planning fee — which may only be hundreds or a few thousand dollars for a single comprehensive financial plan for a client — standard check overnighting policies often still apply, but can quickly create a cumbersome level of postage costs (not to mention the staff time to prepare and mail, receive and deposit, and clear and reconcile) each paper check. So it’s notable that this month, AdvicePay announced the rollout of a new Mobile Check Deposit capability for hybrid broker-dealer enterprises, allowing checks to be immediately deposited (and thus “promptly transmitted”) but without the cost of overnight mailing expenses (especially in what is still a work-from-home environment where handling checks by the individual adviser can otherwise be even more of a hassle). The end result is not only a substantial cost savings for the enterprise (by eliminating the otherwise high volume of postage fees) and refinements for home office staff that can consolidate paper checks and electronic payments (e.g., ACH or credit card charges for financial planning fees) into a single system for tracking, reconciliation and remittance, but also the ability for financial advisers themselves to receive their own share of the advice fees far more quickly (after remitting to the home office for payment back to them through the corporate RIA). All of which expedites the cost-effectiveness for financial advisers to charge stand-alone financial planning fees for their advice, as the fee-for-service movement continues to gain popularity as enterprises seek new paths to reach next-generation clientele who may not have investment assets or a need to buy a financial services product but are willing to pay for advice fees directly from their income (as long as there is an easy way topay?).

Vanguard mirrors BlackRock with new retirement income builder tool as iRetire competitor. As consumer media increasing highlights that for the average investor, the key to long-term financial success is to invest early, keep costs low and let the compounding of markets work in your favor, the accumulation phase of investing seems to have been won by low-cost passive indexing, at which both Vanguard and BlackRock excel. However, the additional complexity of the decumulation phase, from sequence-of-return risk to tax-efficient portfolio liquidation strategies and simply figuring out how to generate the income to power those retirement distributions, still seems to be up for grabs. In fact, both the demand and the complexity of the decumulation phase compared to the accumulation phase mean that even for Vanguard and BlackRock, the expense ratios for their income-producing products are at least double that of the low cost (accumulation-oriented) index funds most invest in. As AdviserTech turns into a distribution channel forasset managers, it’s not hard to see why BlackRock first began to invest in and create digital products to help tell a better income story (from the original acquisition of FutureAdvisor to the rollout of iRetire) in an effort to vertically integrate the AdviserTech asset distribution channel. Accordingly, it’s not surprising that Vanguard recently announced the launch of its own new Retirement Income Builder tool for advisers, which is debuting first in Vanguard Australia but likely will makes its way back across the ocean to the U.S. before long. Providing both a value-add to advisers (to burnish the Vanguard brand when advisers are deciding how to implement their clients' retirement portfolios), and opportunities to outright prompt advisers when building portfolios to implement the solution using Vanguard’s retirement income products (an alternative pathway that brings new assets directly to their retirement income products, rather than the existing approach of simply accumulating as many assets as possible, and then cross-selling those assets into higher-expense-ratio funds later). Notably, an additional upside to bringing retirement income fund distribution closer to home via its own tools is that a product like Retirement Income Builder allows Vanguard to get more ground-level data about what advisers are interested in to figure out which funds to launch next, how to position/market their current income funds and how to train their distribution arm to tell the stories of these products. The larger question, though, is whether or not these large asset managers that build simpler retirement income tools believe they can displace the more sophisticated AdviserTech companies building retirement income solutions in the market today, or if they’re simply trying to cater to less sophisticated advisers who are just starting to dabble in retirement income planning and don’t use any tools at all today. Nonetheless, with the ongoing acquisitions and consolidation of AdviserTech by asset managers, it is clear that more and more of them believe that software is a key part of their future asset management distribution strategy.

FP Alpha launches Tax Snapshot to automate (digital) reviews of client tax returns. While financial advisers are typically not in the business of providing formal advice on resolving tax matters with the IRS, in practice tax planning has long been a staple of the financial planning body of knowledge, and requesting one to two years' worth of tax returns is a standard part of the data-gathering process for many advisers. The caveat, though, is that actually reading and navigating a tax return is complex (so much so that Kitces Courses launched a stand-alone course for financial advisers to practice the skill!). And even for those skilled in doing so, it is time-consuming to navigate what in some cases can be dozens or even hundredsof pages of tax returns. Yet the reality is that because a tax return is a document that everyone must report and file in the same manner, using the IRS’s standardized forms, the process of reviewing every client's tax return is a highly repetitive task that is conducive to greater levels of technology automation. Two years ago Holistiplan debuted as the winner of the 2019 XY Planning Network Fintech competition with a solution that would scan the PDF of a client’s tax return and produce a summary report of the key tax information and prospective tax planning opportunities. And last month, FP Alpha — which last year debuted at the T3 Advisor Technology conference with a software solution that will scan a wide range of client documents, from wills and trusts to insurance documents, to similarly gather key client information try to automate the process of identifying planning opportunities — announced the launch of a new “Tax Snapshot” tool, which similar to Holistiplan will digitally read the PDF version of a client’s tax return to produce a summary of key tax information and prospective planning opportunities. To distinguish itself from Holistiplan as a competitor, FP Alpha’s new Tax Snapshot tool will also allow advisers to create scenario plans for potential tax law changes in the future (e.g., if the recent Biden tax plan proposals to increase rates on high-income clients were to be passed). In the end, most financial advisers will likely still conduct their own reviews of tax returns, if only to verify that the software captured the most salient issues (and to spot the opportunities that may go beyond what the software alone can identify). Nonetheless, whether advisers are trying to do an expedited review of a tax return for a prospect to find immediate opportunities as talking points or as a training and due diligence process to ensure they didn’t missanything important, digital reviews of tax returns likely represent one of the first domains in which technology conducting standardized reviews can greatly expedite the speed and efficiency of the financial planning process (if only because tax returns themselves are standardized enough to be highly conducive tosuch technology automation in the first place). Though with FP Alpha’s goal of analyzing far more than just tax returns, including insurance and estate documents as well, this is likely only the beginning of a new intersection between what the technology alone will increasingly automate in the financial planning process and a new layer of value-adds that (human) financial advisers will need to provide (and have the time to do with the efficiencies that technology can bring!).

T3 Advisor Technology Survey highlights growth of new adviser software categories. With the proliferation of independent adviser software solutions over the past 20 years, the good news is that there’s more choice than ever about what advisers can use to operate their firms. The bad news, however, is that there can be somany choices, it’s hard to keep track of them all (which is why we built our AdviserTech Map!), and it’s even harder to figure out which ones are actually good. To measure this, one of the longest-standing surveys in the industry is the T3 Advisor Technology study, which for years has surveyed the largest number of independent advisers to find out what they actually use and what they like (or not). As the latest 2021 T3 Technology Study results show, the Big 3 of the Adviser Tech Stack continue to be CRM systems (92% market penetration, led by Redtail, Tamarac, Wealthbox and Salesforce), financial planning software (79% market penetration, led by MoneyGuide Pro, eMoney Advisor, RightCapital and Orion Financial Planning), and portfolio management solutions (64%, led by Albridge, Morningstar, Orion, Tamarac, and Black Diamond). Notably, though, the T3 study also identifies a number of other fast-rising categories (e.g., electronic document processing/management is up to 58% market penetration, driven primarily by DocuSign, social media archiving continues to grow with 38% market penetration led by Smarsh, and automated scheduling software is rapidly on the rise with 26% market penetration and is led by Calendly). At the same time, the study highlights a number of categories that have not gained substantive traction, from so-called “robo-advisers” (still only 18% market penetration), and specialized planning tools (as retirement distribution software, beyond financial planning software itself, remains at just 10% adoption and dedicated estate planning tools remain below 5% adoption). Perhaps most notable in the T3 study are some of the up-and-coming new software solutions and categories emerging, including Holistplan’s tax planning software (which, in barely 12 months, has leapt to No. 1 in its tax category, with 8% market adoption), AdvicePay’s financial planning fee payments solution (now also approaching an 8% adoption rate), and data-gathering software, driven by PreciseFP (which has quietly grown to nearly a 5% adoption rate). All of which emphasizes that even though financial planning has been around for decades, there remains room for more competition and innovation around the next wave of software solutions that support not the core financial planning process itself, but the ancillary steps at the beginning (data gathering) and end (payments) process, as well as the areas into which advisers are delving even further to add value in an increasingly competitive environment (e.g., tax planning).

In the meantime, we’ve updated the latest version of our Financial AdviserTech Solutions Map with several new companies, including highlights of the Category Newcomers in each area to highlight new fintech innovation!

So what do you think? Will Voyant be able to gain market share as a competitor in the U.S.? Are digital tax return review tools like Holistiplan and FP Alpha’s Tax Snapshot appealing? Would automated repapering tools like Pershing’s new offering make you more willing to switch platforms?

Disclosure: Michael Kitces is the co-founder of AdvicePay, which was mentioned in this article.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

Special thanks to Kyle Van Pelt, who wrote the sections "Envestnet acquires Apprise as technology to feed Its Trust Services Exchange," "Invesco consolidates its AdviserTech acquisitions under Intelliflo to leverage AdviserTech distribution (globally?)" and "Vanguard mirrors BlackRock with new retirement income builder tool as iRetire competitor." You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt).

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound