It was a good quarter for the giant asset manager. Income soared, assets under management climbed, and the exodus of Barclays clients slowed dramatically.

BlackRock Inc., the world's biggest money manager, said second-quarter profit increased 43 percent as fees climbed along with the assets it oversees for investors.

Net income increased to $619 million, or $3.21 a share, from $432 million, or $2.21, a year earlier, the New York-based company said today in a statement. Excluding certain one-time items, BlackRock earned $3 a share, compared with the $2.89 average estimate of 13 analysts surveyed by Bloomberg.

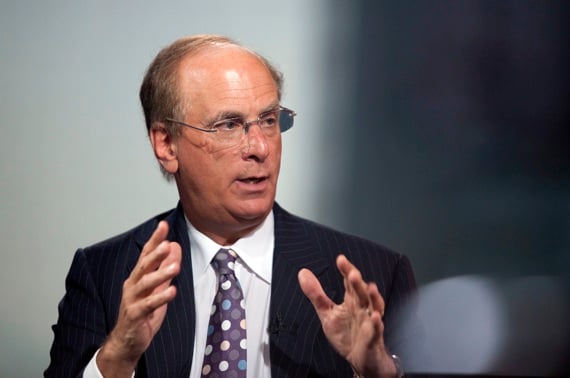

BlackRock, which acquired Barclays Global Investors in December 2009 to add exchange-traded funds to the actively run stock, bond and hedge funds it oversees, said assets under management rose 0.3 percent to $3.66 trillion. Chief Executive Officer Laurence D. Fink said in April redemptions related to the BGI deal are almost over, after clients who wanted to reduce investments with the combined firm pulled a net $139 billion since the transaction was completed.

“One positive to the quarter was that the merger-related outflows are largely over,” Macrae Sykes, an analyst at Rye, New York-based Gabelli & Co., said in a telephone interview before the results were announced. “Industry-wide, fixed- income, alternatives and ETF products did well with investors so that's a positive for BlackRock, too.”

Money managers, who earn fees on the assets they oversee for customers, benefited “despite difficult equity markets” in the second quarter because of investor deposits into bonds, global and hedge-fund-like strategies, Robert Lee, an analyst with Keefe, Bruyette & Woods Inc. in New York, wrote in a July 1 note to clients. Lee, who rates BlackRock “outperform,” expected the money manager to earn $2.81 in the second-quarter, excluding certain one-time costs and gains.

Merger Overhang

“We do expect that organic growth should improve as the overhang from BGI merger-related redemptions may have finally run its course,” Lee wrote in the note.

The Standard & Poor's 500 Index has fallen 2.7 percent since reaching a high on April 29 this year on concern that the economic recovery is at risk and as Europe's sovereign-debt crisis intensified. The MSCI AC World Index has declined 5.6 percent since its May 2 high for the year.

Fink, who co-founded BlackRock in 1988, has built the firm through a series of acquisitions, including the 2006 purchase of Merrill Lynch & Co.'s investment unit. BlackRock acquired the hedge fund-of-funds business of Quellos Group LLC in 2008. The company created a renewable-power unit in February to expand the alternatives division, which manages hedge funds, real estate funds and private-equity strategies.

BlackRock announced results before the start of regular U.S. trading. The shares are down 3.6 percent this year, compared with the 9.2 percent decline in the 18-member S&P index of asset managers and custody banks.

--Bloomberg News--