Jake Northrup doesn’t believe things like the rigors of a 9-to-5 job or mountains of student loan debt should stand in the way of living your best life.

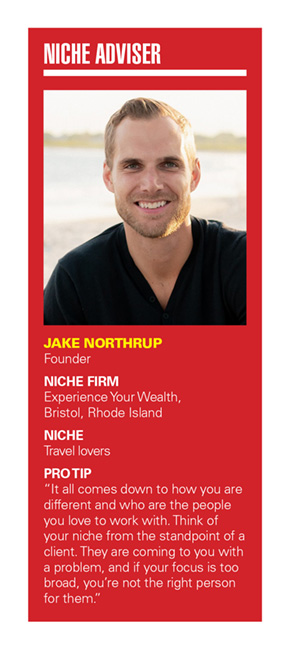

Northrup, 30, is the founder of Experience Your Wealth, a Bristol, Rhode Island-based financial planning practice that is carving out a niche by targeting people just like himself.

“We’ve seen a big trend happening where the idea of retirement is rapidly changing,” he said. “Millennials value experiences, and they’re less likely to stay at a company for 30 years.”

“We help travel-loving young families that don’t buy into the idea 9-to-5, work till you’re 65,” he said. “These people want to experience their money throughout life rather than in retirement.”

Northrup launched his niche advisory firm in 2019 after spending a half-dozen years managing three dozen clients at an RIA in Boston.

The idea for his niche came to him when he realized he wanted to work with people who share his values and have similar demographics. While the passion for travel is the niche, it is also a kind of metaphor for a lifestyle that departs from traditional definitions of success and career paths.

To be clear, Northrup isn't targeting nomads coasting through life without commitment or responsibility.

Across his 50 clients, he said the average age is 37, 80% have children, and the average household income is $250,000 a year.

Most of his clients have one or more of three specific financial planning needs: They are paid some form of equity compensation, they are business owners, or they have more than $100,000 worth of student loans.

Helping clients manage equity compensation is something Northrup picked up at his prior firm.

“It’s complicated, and there are a lot of planning opportunities and planning needs that come with it,” he said. “And equity compensation is a great way to build wealth at an earlier age.”

The business owner aspect is one of those areas where Northrup said he is in harmony with his clients, as a relatively new business owner with an associate adviser who works remotely from Knoxville, Tennessee.

“Your cash flow will be variable, and you’re always faced with the challenge of reinvesting in the business,” he said. “Then there’s issues related to tax planning, how you’re structuring the business, and hiring employees.”

The focus on student loan debt was almost a no-brainer for Northrup. Even though he isn’t personally saddled with a lot of debt, he understands the need for planning around the debt and the dearth of advice available on the topic.

“When I left my last role, I had no fricking idea about student loans,” he said. “That’s not taught in the CFP curriculum.”

To help get up to speed, Northrup upped his game by getting a certified student loan professional designation.

“A lot of people out there who make a lot of money have a negative net worth,” he said.

Northrup’s fee model is based on a formula factoring in net worth and income, with annual fees ranging from $5,000 to $20,000. The average annual fee is $6,000.

“We use the $200,000 household income as a qualifier because it’s a good gauge of whether someone can afford our fee,” he said.

Unlike a lot of niche practices where the focus might be very overt, Northrup’s focus on people who enjoy travel is in some ways filtered through his expertise in compensation, entrepreneurs and people managing student loan debt.

“About 90% of our clients have at least one of those three needs, and they find us,” he said. “They love to travel, want to experience life, and want to be responsible at the same time.”

In line with his own passion for travel-related experiences, Northrup said there's no pursuit of massive growth to create scale at his firm.

“We don’t want it to grow as big as possible,” he said. “We’d be exchanging time, which is finite, for money, which is infinite. We just want to provide a really high level of service for a small number of clients.”

And in terms of walking the talk, Northrup and his wife recently spent $20,000 on a trip to Antarctica, instead of using that money to buy a house.

“The trip is more important to us and aligned with our values more than buying a home,” he said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound