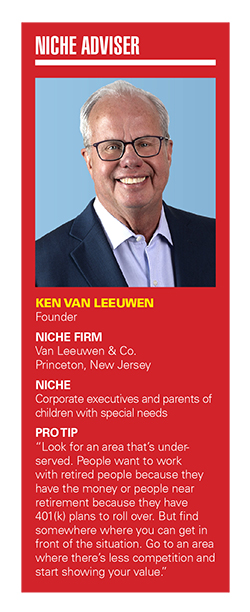

Ken Van Leeuwen’s financial planning business has been built around two niche markets he believes are generally overlooked by the broader financial advisory community: younger corporate executives and parents of children with special needs.

The founder of Princeton, New Jersey-based Van Leeuwen & Co. says his primary niche is corporate executives working in the retail sector.

He was introduced to the market potential several years ago when a client referred an executive at the discount clothing retailer Ross Dress For Less.

“Young corporate executives are not a great candidate for a lot of advisers because they don’t have a lot of money or assets to managed, but they have tremendous needs,” Van Leeuwen said.

“These execs are usually compensated with a salary plus bonus, but also extensively in restricted stock, and options, performance shares,” he said. “To do proper planning for those folks, you need to examine the compensation very carefully and then incorporate it into an overall financial plan and life strategy.”

Van Leeuwen, who launched his firm 25 years ago and has more than $300 million under management, compared navigating the complex compensation structure of his executive clients to playing a game of Chutes and Ladders.

“There are so many pitfalls,” he said. “You do one thing, and another reaction is triggered. You have to understand what happens next and figure out how to maximize the opportunity.”

Van Leeuwen has developed the niche mostly by referrals.

“We do a lot of writing and communicating about our expertise, but the people who hire us talk to their bosses and to each other,” he said. “They start young and climb through the ranks, and because there’s a great runway, they are very upwardly mobile and don’t have a lot of time to focus on their financial needs.”

Also, as the executives move up the ranks and the opportunities for advancement narrow, Van Leeuwen said there needs to be a safety net in place. “From planning perspective, you always need a structure where the parachute can be enacted and where they can feel comfortable if they are out of a job.”

Van Leeuwen’s secondary niche is much more personal and was been inspired by the plight of his 25-year-old son, who lives in a group home and has been a nonverbal autistic since he was 18 months old.

“I realized there was not a lot of information and help available in this area, and financial advisers didn’t specialize in this,” he said. “Most advisers don’t bother to learn about working with clients who have children with special needs, or they just go the standard route of helping them buy an insurance policy.”

Some of the financial planning advice in this area is obvious, he said.

“It is very challenging to accept the diagnosis, but you also start to realize financial planning in a special way,” he said. “For example, you don’t put money into a 529 college savings plan.”

Van Leeuwen currently works with four families that have children with special needs, and he said the first priority is providing benefits for the children when the parents die.

“You have to work with a special needs family to make sure they create some kind of special needs trust within an estate plan,” he said. “If the child gets the money outright, it disqualifies them from any further government benefits, so you always have to educate them not to leave the money to the child directly.”

Van Leeuwen said protecting any potential government benefits will also involve managing the efforts of friends and family members.

“People want to help but you have to make sure they know how to help in the proper way,” he said. “This is an area that nobody makes any money in, so financial professionals don’t necessarily want to touch it.”

Van Leeuwen said he doesn’t have much competition in this niche category and he has never had to market his specialization.

“When people know you have a special needs child, they want to seek you out and pick your brain,” he said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound