Financial advisers want a shakeup in Washington next year by a wide margin, according to a recent poll by InvestmentNews Research. But the outcome of this year’s midterm elections appears more a matter of personal politics than professional interest.

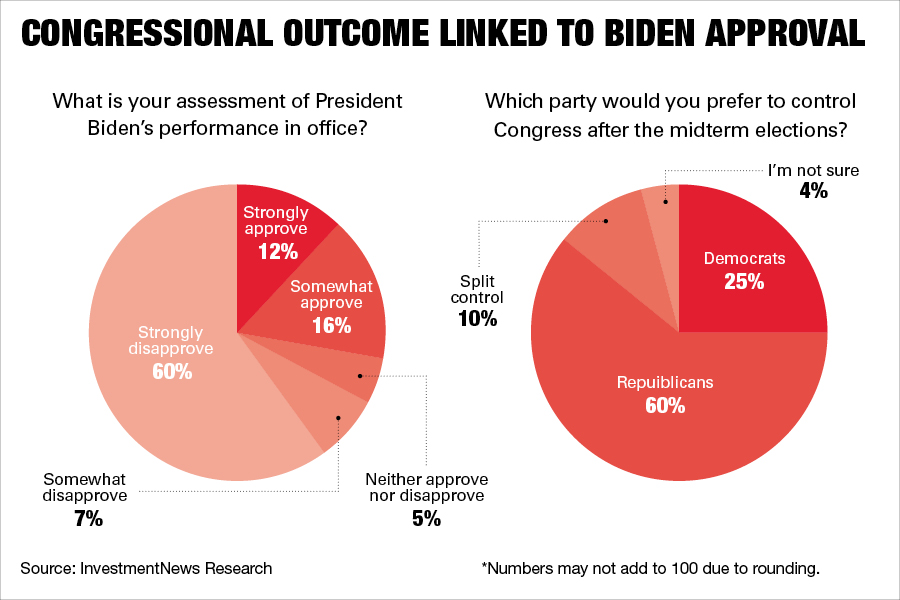

Advisers surveyed preferred that Republicans control Congress when it convenes in 2023, by a margin of 60% to 25%, with others unsure or preferring split control of the chambers. The results were far outside the poll’s margin of error of about 6%.

The partisan split closely resembles the assessment of President Biden, of whose performance in office 67% of survey respondents disapprove. Yet, the survey tilted far more Republican than the general population. According to Real Clear Politics, Democrats led the average generic congressional ballot 45.0% to 43.7% as of mid-September.

Asked what issues a new Congress should focus on, inflation ranked in the top three for 49% of advisers overall. Beyond that, priorities showed a stark partisan divide, with those favoring Republicans listing immigration, crime and taxes as most salient and those with a Democratic preference focused primarily on gun, election and reproductive policy.

Comparatively, industry-adjacent issues like Social Security, retirement policy and financial market regulation were peripheral in the survey.

The president’s party typically loses seats in their first midterm election, and eras of split control in Washington haven’t exactly been ripe for legislation lately. So when it comes to their day-to-day business, advisers aren’t holding their breaths on the ballot count.

Only 22% of advisers surveyed expected that the elections would have a significant impact on the industry.

[More: High stakes in midterm elections]

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound