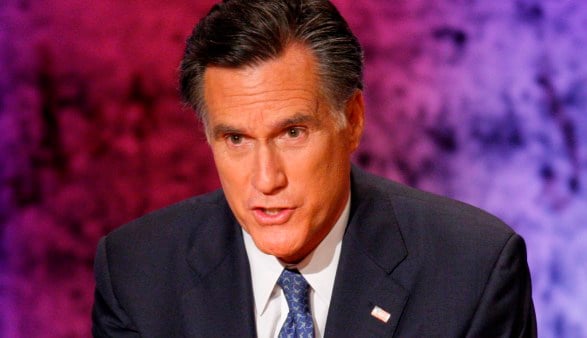

Under pressure from his Republican opponents, former Massachusetts Governor Mitt Romney yesterday abandoned months of resistance and said he would make his 2011 tax return public in April.

The hesitation to disclose is understandable given that Romney, one of the richest men to seek the presidency, probably benefits from a controversial tax break that allows him to pay a lower rate than do millions of American wage-earners whose votes he'll need to capture the White House.

That's because private equity executives, as Romney was for 15 years when he ran Boston-based Bain Capital LLC, receive much of their compensation in what is known as carried interest. That enables them to treat what would be ordinary income for other service providers, taxed at rates as high as 35 percent, as capital gains taxed at 15 percent.

The Republican front-runner said yesterday in Florence, South Carolina, that his effective tax rate was “probably” close to 15 percent because his income “comes overwhelmingly from investments made in the past.”

Yet those investments were largely made by Romney's former partners with other investors' money, not his personal funds. The vast majority of the resulting gains represent compensation for Bain's work acquiring, sprucing up and selling individual companies, critics say.

‘Labor Income'

“This is labor income for them, not a return on capital invested,” said Victor Fleischer, an associate law professor at the University of Colorado whose 2007 paper on the topic helped spark a move in Congress to try to change the law. “It's a method of converting one's labor into capital gains in a way that's unusual outside the investment management industry. Ordinary people wouldn't be able to do this.”

Though he retired from Bain in February 1999, Romney, 64, continues to benefit from the firm's profitable private equity funds and to invest alongside them in so-called “co- investment” vehicles, both of which generate income taxed at the 15 percent rate.

This preferential tax treatment has been castigated by Peter G. Peterson, co-founder of the Blackstone Group, another private equity firm, many tax-policy specialists, and billionaire Warren Buffett. Buffett says it unfairly allows many wealthy investors to pay a lower tax rate than their employees. Even House Majority Leader Eric Cantor, a Virginia Republican, has shown a willingness to scrap the tax provision as part of a deficit- reduction plan that wouldn't increase the government's tax take.

RELATED ITEM Richest presidential candidates ever: Where's Romney stack up? »

For months, Romney -- who pays about half the 31 percent rate President Barack Obama paid over the past three years -- had refused to unveil his tax details. “I don't have any plans right now to release tax returns,” he told reporters Jan. 11. “I paid the taxes required under the law.”

As Romney seeks to lock down the Republican nomination in the Jan. 21 South Carolina primary, that stance crumbled under an assault from fellow Republicans. Onetime U.S. House Speaker Newt Gingrich, Texas Governor Rick Perry, former Utah Governor Jon Huntsman, and former Alaska Governor Sarah Palin all called on Romney to disclose the information.

Gingrich said yesterday that Romney's planned April release, presumably after he would have clinched the Republican nomination, was “nonsensical.” Instead, Romney should make the information public before the South Carolina vote, he said.

“Either there is nothing there -- so why isn't he releasing it? -- or there is something there -- so why is he hiding it?” Gingrich said in Florence.

Lavish Compensation

The tax code's treatment of income from partnerships in private equity, hedge funds and real estate development means that some of the richest people in the country are taxed as if they were bus drivers or health aides. Private equity compensation can be lavish: Three founders of the Washington-based Carlyle Group last year each made $134 million in distributions from their funds against just $275,000 in salary, according to a Securities and Exchange Commission filing.

Amid public concern over rising income inequality, questions about his taxes may be a political vulnerability for Romney in the general election, even though they haven't kept him from winning in Iowa and New Hampshire and leading in South Carolina public opinion polls.

Obama campaign officials see the tax issue as a Romney weakness. John Podesta, who ran Obama's transition in 2008 and retains close ties to the White House, signaled the Democratic line of attack. “He's probably paying lower taxes than a lot of those people who got let go or fired at those companies that he took over,” Podesta said in a Bloomberg Television interview.

‘Unfair Advantage'

Mark McKinnon, a Republican political strategist who advised former President George W. Bush, said in an e-mail the “risk is that he gets more favorable tax treatment than most Americans, and voters would view him as an elitist who gets an unfair advantage.”

Andrea Saul, a spokeswoman for Romney's campaign, declined to comment for this story.

No law requires presidential candidates to disclose their returns, though most have done so since passage of the post- Watergate campaign-finance laws. As a Senate candidate in 1994, Romney unsuccessfully challenged the incumbent, Senator Edward M. Kennedy, to release his tax information. In 1968, Romney's father, then-Michigan Governor George Romney, released his returns during an abortive presidential bid.

In 2000, Bush and running mate Dick Cheney released partial returns before disclosing complete returns four years later. In 2008, Obama and Republican presidential candidate John McCain provided theirs.

Bigger Challenge

Romney, whose campaign estimates his fortune at between $190 million and $250 million, may face a bigger political challenge than most previous candidates because of the nature of the private equity business.

Executives in the industry gather large sums from pension funds, universities and wealthy individuals and typically use the money to acquire privately held companies or subpar units of public companies. After improving the companies' performance, often while working in hands-on management roles or serving on the board of directors, they sell the companies to other investors or take them public.

The executives receive most of their compensation as carried interest, a share of profits made on the fund's underlying investments. The tax code treats those gains as if the private equity partners were risking their own money -- like average Americans who invest in mutual funds -- rather than being paid to run or advise the companies they acquire. In most cases, the private equity firms put up only a sliver of the fund's capital.

‘Fund VIII'

Individual partners like Romney aren't taxed when they're given the right to share in a fund's future profits, even though that right is clearly valuable, said Lee Sheppard, a tax lawyer and contributing editor at the non-profit Tax Analysts of Falls Church, Virginia. “A comparable executive of a corporation would have been taxed at ordinary rates on the award of a valuable equity interest in his employer,” she added.

In May 2004, Bain circulated to investors a private placement memorandum for “Bain Capital Fund VIII.” Marked confidential, the document boasted that Bain (“one of the leading private equity investment firms in the world”) had completed more than 200 deals as of March 2004. The firm's first six funds had realized an 82 percent return, according to the document.

Cayman Islands

Two hundred and seventy four investors signed on, including Romney and his wife, Ann, and pension funds for Texas teachers and Pennsylvania state employees.

Bain Capital Fund VIII, registered in the Cayman Islands, illustrates the special tax provisions that allowed Romney to accumulate wealth both while running Bain and in the 13 years since he left the firm.

Romney and his wife received more than $1 million from the $3.5 billion Bain fund in 2010, according to his most recent financial-disclosure form. Though Bain put up just 0.1 percent of the fund's capital, it's slated to draw 30 percent of the profits once investors are repaid their initial investment, better than the industry standard 20 percent and a reflection of the firm's stellar track record.

Success Stories

The fund's investment successes included the parent company of Dunkin' Donuts (DUNK), which paid investors a $500 million dividend after a successful November 2010 refinancing. A month later, the initial public offering of Fleetcor Technologies in Norcross, Georgia, brought the fund an additional $61 million.

The Bain fund derives more than 99.9 percent of its income from investment gains or dividends, according to copies of Fund VIII's 2010 and 2011 financial statements obtained by Bloomberg News. Under current tax law, those gains and dividends are regarded as the partner's share of the profits, or carried interest.

Bain Fund VIII had just $13,056 in interest income in 2010 compared with $249.8 million in dividends and $665.1 million in realized investment gains, according to the fund's confidential financial results. In the first nine months of 2011, the fund had just $6,539 in interest; $111.9 million in dividends; and, $445.1 million in capital gains.

The Romneys likely paid tax of 15 percent on the vast majority of the $1 million-plus they received from the fund, according to Joann Weiner, a tax analyst with Bloomberg Government and former senior economist with the Treasury Department's Office of Tax Analysis.

$200,000 Savings

Measured against the 35 percent tax on ordinary income, that means the Romneys may have saved in taxes on this single investment at least $200,000 -- an amount equal to four times the median annual income of the typical American household.

And Bain Capital Fund VIII is just one of 31 Bain-related funds that, under a deal Romney struck upon leaving the company in 1999, generated income last year either for Ann Romney's blind trust or her husband's individual retirement account. Combined, those investments in 2010 provided the Romneys between $5.5 million and $21.5 million in income, according to the disclosure form.

The percentage of a fund's payout that is carried interest varies as investments are made, ripen and realized. In a fund's early years, it pays out mostly interest and dividends. Later, as the fund's holdings are taken public or sold off, it realizes large capital gains with specific results depending upon performance.

Mostly Carried Interest

“For the funds that do extremely well, it's almost all carried interest,” said Andrew Metrick, a professor at Yale University's School of Management who has researched industry compensation practices.

It's impossible to say precisely how much Romney saved in taxes without knowing the details of the agreement he reached with Bain when he left the company, and his tax returns.

As an illustration, however, if half of the Romneys' Bain- related income represented carried interest, they would have paid between $550,000 and $2.2 million less in taxes than if that income had been taxed at ordinary tax rates.

Joseph Bankman, a professor of law and business at Stanford Law School and an expert on tax policy, said Romney probably benefited greatly from the tax code's treatment of carried interest.

Big Benefit

“It would be odd if he just made a lot of money from Bain Capital and he didn't benefit a lot from it,” Bankman said. “You'd expect a partner in private equity to benefit enormously from this provision.”

In September, the Obama administration proposed raising $18 billion over the next decade by taxing carried interest at the higher ordinary income rates. The move reprises a 2007 Democratic bid that failed in the Senate amid a lobbying campaign by private equity, hedge fund and real estate partnerships.

Earlier this month, Cantor, a Virginia Republican, confirmed that he was willing to see the carried interest tax break eliminated as part of a deficit-reduction package that didn't increase the government's total tax take. Romney's tax plan, which appears on the campaign's website, is silent on the treatment of carried interest.

The Private Equity Growth Capital Council, an industry group, says carried interest is “fundamentally different in character” from regular wages. Current tax provisions are needed to reward entrepreneurial risk-taking, it says. If such income were taxed at regular rates, private equity investment could decline by $7.7 billion to $27 billion a year, according to a 2010 council study.

‘Causing More Concern'

“Whenever there's more scrutiny, there's more of a chance that the carried tax will be revisited,” said David Jones, an attorney with Proskauer Rose LLP who represents private equity firms. “It's fair to say it's causing more concern.”

For the Romneys, the tax savings on their Fund VIII income could be even larger than the above analysis suggests. Many of their Bain funds, including Fund VIII and a companion vehicle in which Romney was allowed to invest his own money, are held in Ann Romney's blind trust, according to the financial disclosure form.

Federal election law doesn't require candidates' spouses to specify income streams above $1 million. If the funds were in Mitt Romney's name, he would be required to say whether the amount was between $1 million and $5 million or greater than $5 million.

--Bloomberg News--