A year of economic headwinds slowed recruitment in the advice industry in 2022 but did little to deter advisors from moving toward independence.

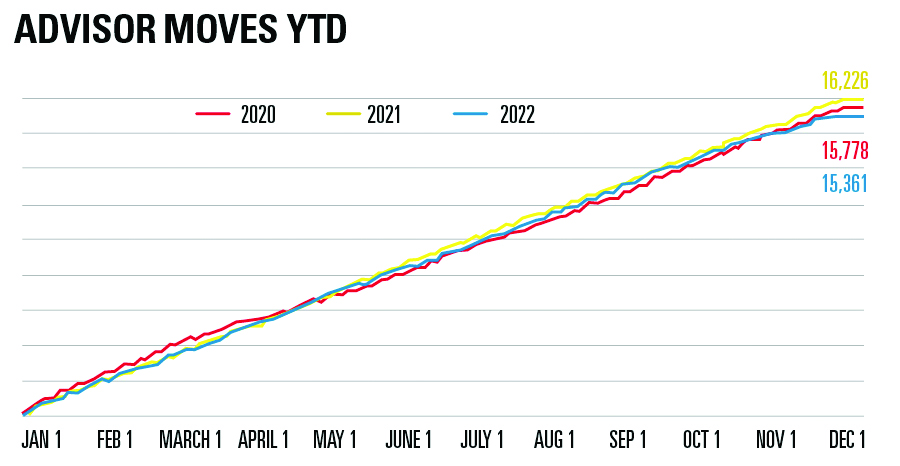

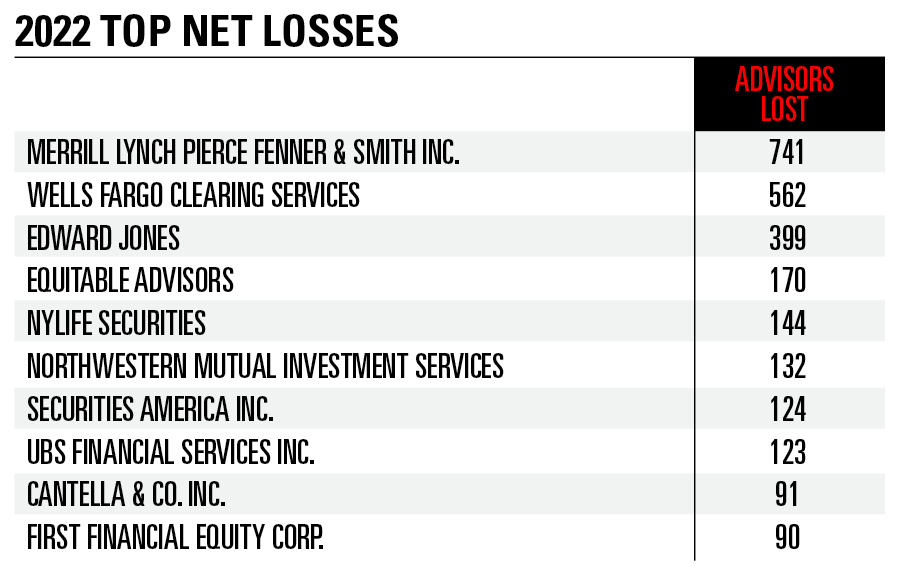

Total moves of advisors between firms fell 5.3% from 2021, according to an analysis of our Advisors on the Move database. More significantly, the 15,361 advisors who switched firms in 2022 was lower even than in disruption-filled 2020, and 16.3% below 2019.

Only 5,372 advisors moved between firms within the same channel — wirehouse to wirehouse, for example — the lowest since at least 2009, indicating that firms are continuing to shy away from the most competitive (and expensive) forms of recruiting, especially as the market takes its toll on asset-based fees.

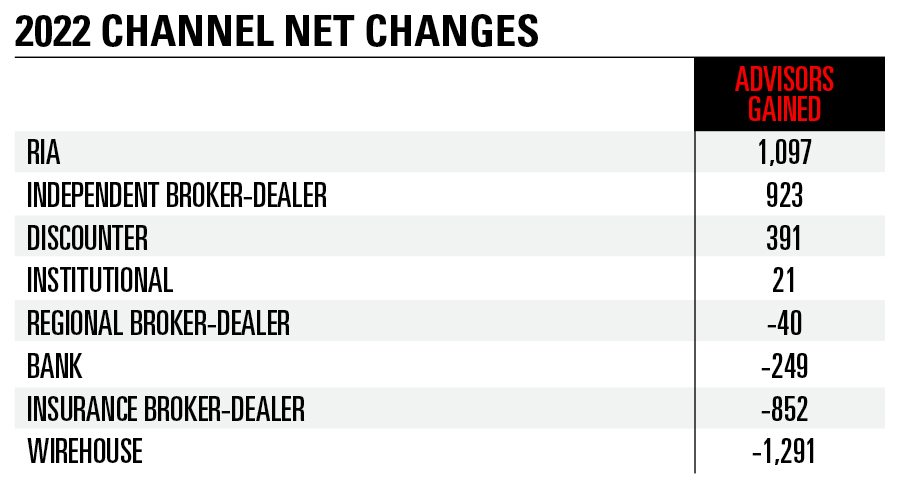

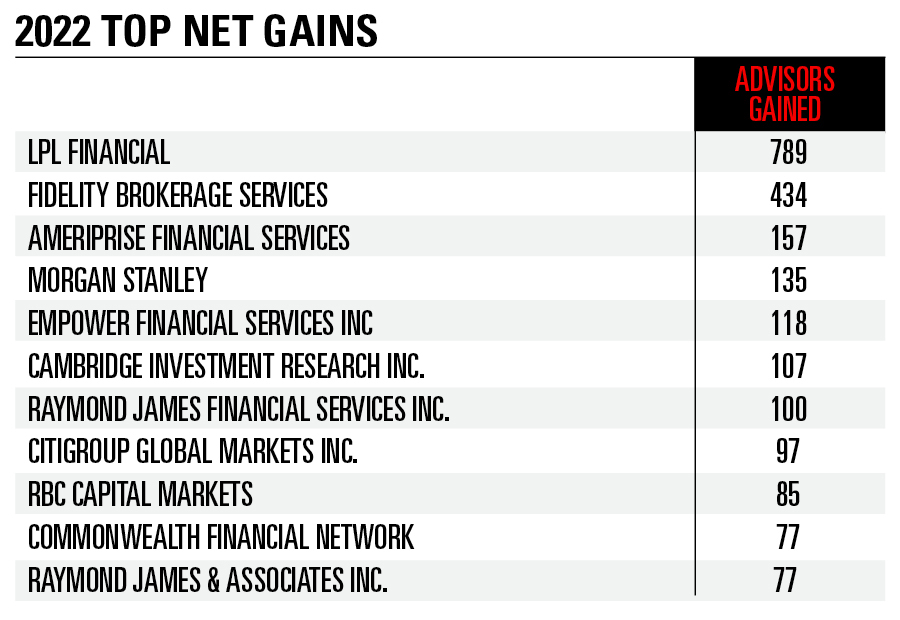

Transitions were down across the board, but advisors continued to move in large numbers to RIAs and independent broker-dealers. Greater flexibility has long driven advisors to these channels, often for personal motivations, limiting the effects of the economic backdrop.

Firms of all kinds constantly adapt to retain advisors and clients, said Nick Rygiel, founder of Ironclad Financial. That means breakaways should be about fundamental changes.

“Eventually all good ideas will find their home everywhere,” said Rygiel, who left Merrill Lynch after 10 years to launch his RIA in July. “So, for someone that really wants to leave, it has to be a decision personally that is beyond just frustration. It’s really to pursue something they can’t in their current situation.”

On net, the RIA channel gained 1,097 advisors and independent broker-dealers gained 923, while 1,291 advisors on net left wirehouses. And that doesn’t fully encompass wholly new launches of RIAs, which have ramped up since 2020.

The Securities and Exchange Commission received 1,229 registration applications in the first nine months of 2022, according to an analysis of Form ADV data. That’s down about 19% from 1,516 through September in 2021, but well above the 960 the agency received during the comparable period of 2019.

Part of the counterintuitive steadiness in new firms during the past two years, even as markets soured, may be that founders typically spend one to two years preparing to launch. So, the industry could just now be seeing plans made during 2020’s surge in remote work come to fruition.

“The joy of having breakfast with my kids every day is something I realized very quickly I did not want to give up,” said Kelly Klingaman, who founded an eponymous financial planning firm in May. “The pandemic really solidified for me the idea that I knew I wanted to work for myself and have more control over my schedule.”

And since startup costs can be relatively low, especially with clients now accustomed to virtual services, the financial considerations around starting a business often revolve around a savings runway to replace an advisor’s lost income rather than access to startup capital, interest rates and other broader economic factors.

“I don’t feel like there’s ever the perfect time to start a business or start in financial services, so you have to go when it makes sense for you,” said Jamie Clark, founder of Ruby Pebble Financial Planning in Seattle, which launched in October.

While 2022, a year in which the S&P declined nearly 20%, may not seem like the ideal time to start a new firm, advisors who struck out on their own say they’ve benefited from starting in a bear market. Clients tend to reach out more in times of uncertainty, testing the quality of communication and relationships at established firms. That can be an advantage to new firms building a book from scratch.

“I actually don’t see the economic backdrop as being a hindrance,” said David Edmisten, a longtime broker who started Next Phase Financial Planning in August. “Oftentimes if everything’s running smoothly for a client, they’re not inclined to change. But when people start having questions, it’s a great time to engage.”

“Economic uncertainty gives people reasons to question, ‘Am I with the right provider?’” he added.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound