A Tax Policy Center study has estimated that in 2015, Romney would need to eliminate $320 billion in tax breaks, or 30% of the total, to pay for his proposed 20% reduction in tax rates.

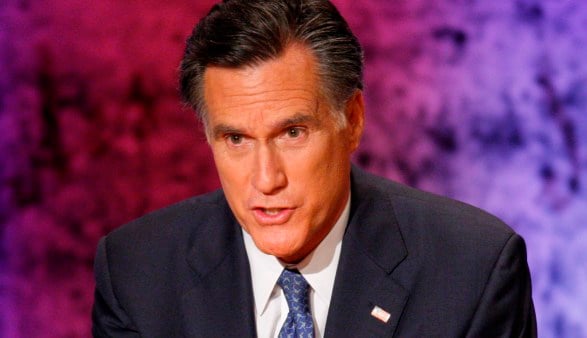

The cut in individual income tax rates proposed by Republican presidential candidate Mitt Romney can be kept revenue-neutral only by curtailing or eliminating many popular tax breaks, according to a nonpartisan study.

The study released today by the Tax Policy Center in Washington estimated that in 2015, Romney would need to eliminate $320 billion in tax breaks, or 30 percent of the total, to pay for his proposed 20 percent reduction in tax rates.

Because those tax breaks are supported by lawmakers, taxpayers and interest groups, that goal sounds easier to achieve than it really is, said Roberton Williams, a co-author of the paper. He said President Barack Obama got nowhere in Congress in proposing much less far-reaching limits on tax breaks such as the deductions for mortgage interest and charitable contributions. Republicans and Democrats, the real estate industry and non-profit groups criticized curtailing those tax breaks.

“You've got to get a big chunk of very popular tax preferences to recoup the revenue loss,” said Williams, a senior fellow at the center.

Romney has called for reducing individual income tax rates by 20 percent, lowering the corporate rate to 25 percent from 35 percent and eliminating the estate tax and the alternative minimum tax. He hasn't said what tax breaks he would curtail to make up for the lost revenue.

Upper Income

“Broadening the tax base would mean going into things like all of the deductions and scaling them back for upper-income people in particular,” Glenn Hubbard, a Romney economic adviser, said on Bloomberg Television April 17. “There are hundreds of ways to do that.”

Romney has said his proposal wouldn't affect the current distribution of the tax burden among different income levels, and he has suggested that tax breaks may be eliminated or limited only for higher-income taxpayers.

Broad reductions in tax breaks, the study said, would tend to raise the effective rate for middle-income taxpayers.

Taking tax breaks for retirement savings, capital gains and employer-provided health insurance off the table would make the task more difficult, according to the study.

'Very Difficult'

“It is possible to maintain revenues in the face of large marginal tax rate cuts by paring back tax expenditures, but it would be very difficult,” the study said. “The task becomes much harder if another objective is to maintain the progressivity of the federal income tax.”

Romney's plan would repair the tax code and stimulate entrepreneurship and job creation, said Amanda Henneberg, a campaign spokeswoman, in a statement.

“This study is independent confirmation that even employing an economic model that ignores the pro-growth effects of reducing tax rates, these goals can be met,” she said.

The Obama campaign has criticized Romney for not saying how he would offset the cost of the tax rate cuts.

“He refuses to say how he'd pay for that massive tax cut for the wealthy, which means he's either exploding the deficit or, according to independent analysts, raising taxes on the middle class by closing tax breaks for mortgages, health care, retirement and other benefits the middle class rely on,” Ben LaBolt, an Obama campaign spokesman, said in a statement July 9.

The study didn't consider what it would take to offset the cost of Romney's proposals to eliminate the estate tax and reduce the corporate tax rate. It also didn't consider changes other than curtailing tax breaks.

The analysis said reducing tax rates would make it harder to offset the lost revenue by limiting tax breaks, because the breaks become less valuable when rates are lowered. The Tax Policy Center is a joint venture of the Urban Institute and the Brookings Institution.

--Bloomberg News--