Families earning more than $250K lose incentive; those without plans can access an auto-IRA

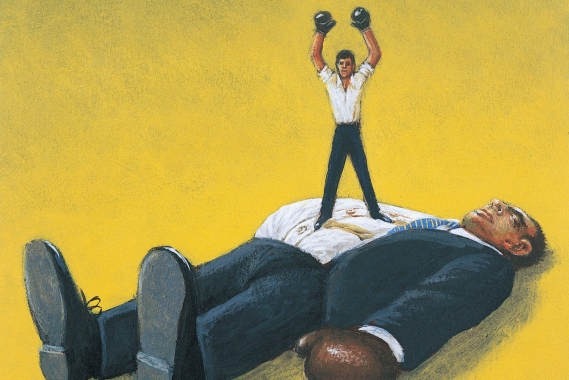

President Barack Obama's budget proposal is making high-income earners flinch as they lose retirement savings incentives, but there's good news for workers who don't otherwise have a way to save at work.

Mr. Obama's $3.8 trillion budget for 2013 already heaps higher taxes onto individuals earning at least $200,000 and families making upward of $250,000: Rates on dividends are proposed to jump to 39.6%, from today's rate of 15%, while the president also suggests a 30% minimum tax for individuals with at least $1 million in annual income.

The proposal also takes aim at the tax deductions higher-income families enjoy, including those that apply to retirement contributions. Mr. Obama is proposing to reduce the value of itemized deductions and other tax preferences to 28% for families with income over $250,000. By removing the tax break for retirement savings, the administration would shave off $584 billion from the nation's deficit over 10 years.

That provision was met with fiery resistance from the American Society of Pension Professionals and Actuaries, which claimed that the removal of the incentive not only would punish higher-income workers for saving but hit them with a double tax — a surcharge on the contributions to the plan and an income tax at the time of the money's withdrawal.

“If I'm already taxed at the 35% rate, but I'm only getting a 28% deduction, then I'm paying a 7% surcharge on my retirement savings contributions,” said Brian Graff, ASPPA's CEO. “And then I'll be paying taxes again when the money comes out. People really don't want to be double-taxed.”

Observers noted that the proposal would be bad news for business owners, as they'd have decreased incentive to open the plans in the first place.

“It makes the incentive smaller for the business owner,” said Randolf H. Hardock, a partner at Davis & Harman LLP. “Often the trade-off for the small-business owner is the cost in fees and administrative costs, how much the employees want it and fiduciary responsibilities in setting it up. But what's in it for the employer?”

Were those provisions to go through, more investors and employers would take a closer look at Roth IRAs and Roth 401(k)s so that after-tax dollars could go toward savings.

Nonqualified deferred-compensation programs might also warrant a second look by individuals earning more than $200,000, according to Gavin Morrissey, vice president of wealth management at Commonwealth Financial Network. Those plans often involve the use of permanent life insurance, and the employee isn't taxed on the deferred-compensation benefits until he or she receives the benefits in cash at retirement.

While the proposal might be bad news for higher-earning Americans, there's a bright spot for workers at small companies that don't currently have a retirement savings plan. The president is calling for the return of the automatic IRA, along with a series of tax incentives for small businesses to begin using the plans.

Under the proposal, businesses that didn't already offer a plan would be required to enroll their workers in a direct-deposit IRA compatible with existing direct-deposit payroll systems. Workers would have the opportunity to opt out if they preferred.

Businesses with ten or fewer workers would be exempt from the requirement.

Mr. Obama is also calling to increase the maximum tax credit available to small employers setting up new retirement plans to $1,000 per year, from $500, and the credit would be available for four years.

These IRAs would be exempt from the Employee Retirement Income Security Act of 1974 and its requirements. However, they most likely would be subject to their own rules, which would have protections comparable to what's available via the Employee Retirement Income Security Act of 1974, such as required fee disclosure, Mr. Graff said.