The February edition kicks off with the big news that robo-adviser Wealthfront has been sold for $1.4 billion to UBS, an acquirer from among the “traditional” financial services firms that Wealthfront once proclaimed it would disrupt. UBS has indicated it will pair Wealthfront’s technology with UBS’ human advisers, advisers Wealthfront sought to displace. In fact, it’s notable that Wealthfront’s $1.4 billion sale is just double its $700 million valuation back in late 2014, which means the company’s valuation didn’t even keep pace with the broader growth of the stock market since then (with the S&P 500 up over 150% over the same time period).

Though perhaps most significant in Wealthfront’s exit is the fact that despite Wealthfront being the first to turn direct indexing into a technology solution, it’s actually other direct indexing platforms over the past few years that have been achieving even higher growth rates and valuations than Wealthfront, by eschewing Wealthfront’s direct-to-consumer approach and working with financial advisers instead — an industry nod to how powerful the adviser-client relationship really is in the end.

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

In addition, this month marks the debut of the inaugural Kitces Independent Advisor Technology Study, showing the latest trends in what advisers are adopting or not and which technology tools they’re most satisfied with or not. As in the end, it’s the independent advisers who control their own technology decisions — and can most readily “vote with their feet” about what is reallythe best technology or not — who provide the best insight into what will become the most popular adviser technology tools in the future.

In the meantime, we’ve also launched a beta version of our new Kitces AdvisorTech Directory, to make it even easier for financial advisers to look through the available adviser technology options to choose what’s right for them.

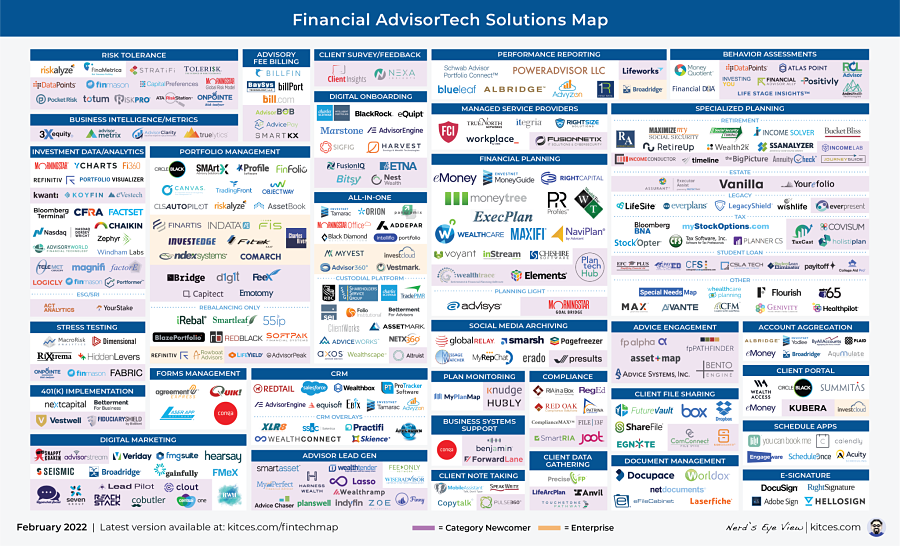

Be sure to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map as well!

AdviserTech companies that want their tech announcements considered for future issues should submit to TechNews@kitces.com!

Back in 2014, the first wave of robo-advisers was experiencing rapid growth and even more rapidly growing expectations, to the point that Wealthfront raised $64 million of capital on a whopping $700 million valuation, despite having only $1.5 billion of total assets under management (which at its fee schedule amounted to less than $4 million of actual revenue). At the time, the firm was rapidly rolling out new features, including its just released Wealthfront 500 — an attempt to take Parametric’s direct-indexing strategy for ultra-HNW investors, and democratize it for the mass affluent.

In the years that followed, Wealthfront continued to grow, but in a direction that increasingly pivoted away from its core robo-adviser offering, as more and more industry incumbents created their own competing solutions, thus diminishing Wealthfront’s growth rate and momentum. The firm began to roll out a high-yield (non-managed) cash offering, added more financial planning capabilities to its technology platform, and began to focus itself on becoming a more holistic offering that would help clients automatically steer their dollars to the right place with its Self-Driving Money approach.

Now, after reaching $28 billion of assets on its platform, Wealthfront announced that it has been sold to UBS for a whopping $1.4 billion valuation. On $28 billion of assets and its 0.25% pricing schedule, that amounts to about $70 million of revenue, implying that Wealthfront was sold for a stunning 20 times its gross revenue (stunning in that Wealthfront isn’t exactly in the exponential explosive growth rate phase anymore, when such valuations are more common). And raising questions about how, exactly, UBS intends to monetize Wealthfront itself.

Notably, Wealthfront’s tech-savvy approach for do-it-yourself investors had a strong appeal in Silicon Valley itself, and in general means the firm has been able to attract a heavy dose of the next-generation high-income, upwardly mobile market among its 470,000 clients as Wealthfront’s tech-centric approach has reportedly continued to keep the company skewed toward younger clients, even as other robo-advisers attracted a more age-diversified client base. That provides UBS the opportunity to capture those households as they continue to grow in wealth and assets over time, and the opportunity to cross-sell them everything from UBS products (to expand revenue per client) to pairing them with UBS advisers, ironically, turning Wealthfront’s anti-adviser platform into a nurture pathway for UBS’ human advisers after all. In fact, for UBS, acquiring 470,000 next-generation upwardly mobile clients for just $1.4 billion represents a client acquisition cost of just $2,979, which is remarkably in line with the Kitces Research estimate that financial advisers have an average client acquisition cost of $3,119.

Also notable as a part of the acquisition is that UBS gains the direct-indexing technology that Wealthfront had built, as direct indexing itself has experienced its own explosion of interest over the past 18 months, from Morgan Stanley acquiring Parametric to BlackRock acquiring Aperio, Vanguard buying JustInvest, JPMorgan acquiring OpenInvest, Franklin buying Canvas, and storied venture capital investor Sequoia investing in Vise at an even more eye-popping $1 billion billion despite Vise not even having $1 billion of assets under management.

That means, ironically, that Wealthfront’s insistence on trying to replace financial advisers — and thus failing to distribute its direct-indexing technology tofinancial advisers, with a five-year head start over even-more-recent startups that have already been acquired — means it may have missed the boat on the largest growth opportunity it actually had. Especially given that a valuation of $700 million in 2014 means that in the 7½ years since, the growth of Wealthfront’s valuation (up 100% to $1.4 billion) didn’t even match the S&P 500 (which was up over 150% over the same time period). Even Vanguard’s human-based Personal Advisor Services achieved nearly 10 times the asset size of Wealthfront in less time, and individual advisory firms like Mallouk’s Creative Planning organically grew more assets since 2014 than Wealthfront. And direct-indexing solutions for financial advisers achieved even higher valuation multiples than Wealthfront’s.

Nonetheless, in the end, building a $1.4 billion company into the niche of tech-savvy next-generation do-it-yourself investors, whose lead value alone for 470,000 clients can justify a $1.4 billion purchase, is still a tremendous success in itself, even if it never fulfilled Wealthfront’s vision of disrupting and displacing the human financial adviser. But it also helps to emphasize how incredibly large and fractured the financial services landscape is really, and how much power the human relationship with a financial adviser still holds, both to attract and retain clients, and as a pathway for bringing investment solutions to them.

Financial advisers are often highly resistant to new investment trends. In large part, this is driven by the reality that as clients are constantly pitched hot new investment ideas — from the media, investment platforms, or their sister-in-law’s niece’s fiancé at the last family gathering — advisers are put into the impossible position of vetting all of those ideas, to the point that often it’s easiest to just say, “If it sounds too good to be true, it probably is” and move on, because it isn’t economically feasible to chase down every pitch.

Of course, every now and then, a new investment idea gains adoption and momentum, to the point that it can no longer be ignored. Even at that point, though, it’s often difficult for advisers to actually integrate new investment offerings because their systems and processes — from how they report on and monitor investments, to how they’re managed and traded — are built for their existing approach, and retooling takes time and energy that again isn’t economically feasible if only a small segment of clients were likely to adopt anyway.

Over the past several years, Bitcoin and other cryptocurrencies have followed this similar trajectory, with years of less than 2% of advisers in the annual Journal of Financial Planning Trends In Investing study showing any interest in investing into any crypto assets, as advisers reflexively said “no” year after year. However, the explosive growth in the prices of Bitcoin, Ethereum, and other crypto assets in 2020 — paired with a parallel explosion in media coverage — led to a shift in the latest 2021 Trends In Investing study, which for the first time showed a real growing interest among advisers in starting to utilize crypto for at least some of their clients.

The caveat, though, is that advisers still didn’t have the systems to implement crypto investing. In 2021, that set off an emerging arms race in the financial services industry to figure out how to capture adviser interest and available client assets. Traditional financial services firms tried to roll out ETFs that financial advisers could use, while others like OnRamp tried to build integrations between crypto exchanges and financial adviser systems, and others like Bitria (i.e., Bitcoin-for-RIAs) developed separately managed account and TAMP (or as Bitria puts it, Digital-TAMP or DTAMP) offerings that advisers could plug into.

Now, the news is out that crypto exchange Gemini is acquiring Bitria directly in an effort to scale up their adoption in the adviser channel. In the context of the broader crypto landscape, Gemini is one of the smaller crypto exchanges, in an environment where it’s difficult to differentiate for consumers, and Gemini appears to be making a bet that by building more directly to advisers, it can position itself to capture adviser crypto interest while the rest of the crypto exchanges continue to focus on the direct-to-consumer retail market.

The Gemini deal is notable in that it doesn’t necessarily bring crypto to advisers’ existing platforms as opposed to a publicly traded crypto ETF that advisers could purchase on their existing custodial platforms. Instead, similar to Flourish Crypto, it remains focused on advisers buying and maintaining custody of their crypto via Gemini (as traditional broker-dealers and custodial platforms are not built to handle the unique challenges of crypto custody) while packaging the offering into more traditional adviser wrappers (SMAs or TAMPs) for crypto that would just happen to sit on an alternative custodial platform such as Gemini.

In turn, the Gemini/Bitria deal could create additional opportunities for adjacent players like OnRamp, which has already been building integrations between Gemini and various portfolio performance reporting tools that advisers use so they can track and report on client assets that are invested into crypto on nontraditional adviser platforms — unless Gemini begins to build those integrations for itself more directly?

Ultimately, though, the big question that remains is whether advisers will tolerate having an entirely separate custodial relationship for their clients’ crypto holdings even as technology tries to make it less cumbersome, versus either buying crypto in ETF format (if/when a spot crypto ETF eventually comes to market) or if some RIA custodian eventually figures out how to operate as a crypto exchange itself making held-away accounts at Gemini a moot point. And of course, there’s still the matter of whether adviser adoption in crypto itself will maintain its momentum, especially with Bitcoin prices down nearly 40% from their 2021 peak.

Nonetheless, the Gemini/Bitria deal remains notable in that advisers themselves are increasingly becoming a target for crypto platforms and crypto managers. It remains to be seen whether advisers are really willing to go through the additional trouble and cost of adding separate custodial platforms, especially if, given the volatility, advisers may only be allocating a very small (1% to 2%?) allocation to client portfolios in the first place?

For nearly 15 years, from the late 1990s to the early 2010s, direct indexing was a fairly niche offering, with early pioneers like Parametric and Aperio creating strategies that could replace index funds with the individual component stocks of the index, in order to capture the tax-loss-harvesting opportunities of each individual stock. Notably, though, the strategy really only worked for ultra-high-net-worth investors, who had the right combination of the top tax brackets to make the tax-loss harvesting worthwhile and large enough portfolios to not get buried in transaction costs buying so many individual stocks.

In the 2010s, though, the rise of fractional shares combined with the collapse of trading commissions to zero suddenly made it feasible to implement direct indexing for the mere mass affluent investor, starting with early robo-adviser Wealthfront launching its low-minimum Wealthfront 500 in 2014. Once it became feasible to put direct indexing in the hands of consumers, it also became clear that consumers didn’t have to just buy an index fund; instead, buying the component stocks of the index also made it feasible to modifythe index, ushering in a new wave of SRI- and ESG-oriented platforms (e.g., JustInvest, OpenInvest) where consumers could begin to customize indexes to their own personal preferences.

Notably, though, consumers aren’t the only ones who may want to modify the weightings of individual stocks in an index based on their preferences; advisers who manage portfolios can leverage direct indexing as a portfolio construction tool as well, from building portfolios with their own ESG/SRI preferences, to implementing factor tilts (e.g., overweight small-cap and value), to implementing their own more proprietary stock-picking strategies.

In January, direct-indexing provider Veriti Management announced a partnership to implement Rob Arnott’s Fundamental Indexing strategies, in the largest instance yet of a proprietary indexing strategy being deployed via direct indexing technology.

From the perspective of Arnott’s Research Affiliates, the Veriti deal provides a new way to distribute Arnott’s RAFI Indices beyond the traditional mutual fund and ETF format, which may be particularly appealing to high-net-worth investors who want to combine Arnott’s fundamental indexing approach with the tax-loss-harvesting benefits uniquely available to ETFs. From the Veriti perspective, the deal — ostensibly an exclusive one for being the direct indexing provider for RAFI Indices — creates a proprietary value proposition for another prone-to-commoditization technology offering by being able to uniquely distribute a popular investment strategy.

From the adviser perspective, though, the unique significance of the RAFI-Veriti deal is that it signals direct indexing may not just be a way to own a traditional index with tax-loss-harvesting benefits, or to engage in more personalized indexing for clients with particular ESG preferences, but that direct indexing technology — and the tax-loss-harvesting benefits that accompany it — can become a distribution channel for other individual stock managers who want to pair direct indexing’s tax benefits with their own investment strategies. That raises the question of whether it’s only a matter of time before more asset managers begin to roll out their investment strategies in a direct indexing format as a standard complement to traditional ETF and mutual fund wrappers?

One of the indirect effects of the ongoing commoditization of building diversified asset-allocated portfolios is that financial advisers are increasingly pressured to do more — from bringing deeper expertise to the table, to outright providing more services — to justify their existing fee schedule. The good news is that ongoing technology improvements are making the portfolio management process efficient enough to be able to provide clients with more financial planning and other services. The bad news is that advisory firms aren’t necessarily built to scale additional services the way they’ve traditionally offered their core.

This challenge is increasingly evident in the rise of a recent new generation of estate planning solutions for financial advisers. In the past, estate planning software was focused primarily on diagraming the flow of a client’s estate assets if they passed away… with a particular focus on the share that might go to Uncle Sam in the form of estate taxes, which in turn generated estate planning business opportunities for the adviser (e.g., a big second-to-die life insurance to provide liquidity to pay the estate taxes). But as the estate tax exemption has risen dramatically over the past 25 years — from $600,000 in the mid-1990s to $3.5 million by 2009 to $12.06 million today (and twice that for a married couple) — estate planning is increasingly shifting from planning for estate taxes, to simply ensuring that the estate itself is planned for, with documents put in place to guide where assets should flow and who will be responsible for them.

In this context, it’s notable that last month Trust & Will raised a fresh round of investor capital (from the new UBS Next FinTech fund) to further accelerate the growth of its offering for financial advisers, which leverages its technology platform to prepare estate planning documents for advisers’ clients (i.e., wills and trusts, as the name implies) at a significantly lower cost than a traditional estate planning attorney. Notably, the UBS Next fund is built specifically for UBS to take stakes in strategic partners that may work with UBS, suggesting that Trust & Will may soon be rapidly expanding its adviser reach by working with UBS’ own multi-thousand adviser base, even as it tries to scale up with the independent adviser community as well.

At the same time, this month also brought the news that Helios Estate Planning — a competing service creating estate planning documents for advisers and their clients that abruptly shut down in December — is being relaunched by its former vice president of sales turned CEO. The returning offering, rebranded as EncorEstate Plans, has said that it plans to remain focused on working with financial advisers as a back-office (i.e., the adviser remains in the lead with the client) estate planning solution that helps clients get their basic estate planning documents in place.

Ultimately, the core question is simply how many financial advisers reallywant to open the door to facilitating their clients getting estate planning documents, given that historically, it was lucrative to be so involved because of the potential life insurance sale, not as a value-added service unto itself. Still, though, with ongoing pressure on advisers to demonstrate more value beyond the portfolio for the fees they charge, both Trust & Will and EncorEstate are making growing bets that advisers will want to bundle estate planning documents or at least, helping their clients get those documents at a more affordable cost, into their own advisory firm offering.

One of the biggest drivers of the growth of the independent RIA movement is the relatively low compliance burden to become an RIA, particularly relative to operating under a broker-dealer. While the standard of care for an RIA is a higher fiduciary standard than that applicable to broker-dealers, the reality is that when an individual starts their own RIA, the only person they have to oversee is themselves, which means compliance is quite manageable compared with broker-dealers that may have dozens, hundreds or thousands of brokers, necessitating multiple layers of compliance given the sheer number of people and activities involved.

At the same time, while RIA compliance is not overly burdensome, especially for the small firm, it does still entail a nontrivial number of repetitive tasks that must be implemented and documented, from maintaining books and records to annual ADV updates to vendor due diligence. And as the firm begins to hire employees, the scope expands further, with trade monitoring and quarterly transaction and annual holding reports. That makes it especially conducive to technology that can help automate or at least, greatly expedite recurring parts of the process.

In recent years, this has led to the rise of several RegTech solutions that help RIAs fulfill their compliance obligations, including RIA In A Box, SmartRIA, ComplianceGuardian, Joot and more. All are built around a framework of establishing an annual compliance calendar that highlights the compliance obligations that an RIA must fulfill each month and then helping to ensure that all the tasks are completed and documented accordingly.

In this context, it was notable that in the past two months, RIA In A Box was acquired by ComplySci, and Dynasty Financial Partners and MarketCounsel both took a stake in SmartRIA, signaling a divergence in the focus of the two platforms.

In the case of RIA In A Box, acquirer ComplySci took a substantial $120 million investment from K1 Investment Management last summer, which also previously acquired social media archiving platforms Smarsh and Actiance, with a stated vision of becoming the largest RIA compliance provider with the greatest scale. ComplySci promptly deployed its fresh capital with the acquisition of NRS last October, now followed by RIA In A Box, as the firm ramps up to become the largest provider of RIA compliance technology. That in turn will give ComplySci the depth to expand its services into adjacent RIA verticals, including compliance for hedge funds and private equity firms, signaling that RIA In A Box may try to move further upmarket into larger RIAs.

By contrast, SmartRIA appears to be staying focused in the core small-to-midsize RIA market itself, particularly midsize RIAs that have more than five employees and thus a more substantive compliance burden to manage and streamline, with the new infusion of capital tied to strategic partnerships with Dynasty Financial and MarketCounsel themselves, both of which stated that their advisers will be adopting the SmartRIA platform as their compliance solution in the coming months to augment SmartRIA’s existing 2,100-firm user base.

Ultimately, though, the real significance of the ongoing growth of RIA compliance technology is simply that as technology makes compliance more manageable, it reduces the fear of advisers at broker-dealers, where compliance is handled for them, about transitioning to the RIA model where technology helps to reduce the potential compliance burden. Dynasty in particular appears to be making a bet that a stronger offering of compliance technology will help grease the wheels for breakaway brokers to transition to Dynasty’s large-RIA platform. Though in the end, technology helping to better streamline and automate compliance processes is likely to see ongoing rising demand for many years to come as the RIA movement continues and RIA firms inevitably accumulate clients, staff and greater compliance burdens for technology to continue to streamline.

In the early days of financial adviser technology, the CRM system was effectively a digital replacement of the physical Rolodex — a compendium of client contact information, including names and phone numbers, and perhaps some basic tracking about recent communication regarding whatever product the adviser was currently trying to sell them.

As the advisory business began to shift from transactional to relationship, though, the depth and breadth of adviser CRM capabilities began to shift. Simply capturing contact details and recent correspondence was no longer sufficient; an increasing breadth of complexity associated with the more holistic wealth management offering meant advisers needed to capture more information about their clients, which in the late 1990s and early 2000s spawned the rise of more adviser-specific CRM systems like Redtail, Protracker and Junxure CRM.

In recent years, though, the ever-widening breadth and complexity of the services that advisers provide means services that span investment management and financial planning, necessitating a flow of data across the systems that support each, are creating a growing pressure on CRM systems to become the central source of truth about client data and form the hub of the adviser’s entire business as the expansion of financial planning services means advisers can no longer rely on their broker-dealer or RIA custodian systems as their central platform anymore.

In this context, it’s notable that this month, long-standing adviser CRM competitor Junxure announced a relaunch and full rebrand as AdvisorEngine CRM (named after the AdvisorEngine platform that acquired Junxure away from its original founder back in 2018).

The relaunch is important because Junxure itself was historically an adviser CRM that had struggled with the migration to the cloud such that for years it retained a significant base of desktop users who didn’t want to migrate to the not-fully-at-parity earlier cloud versions of Junxure. AdvisorEngine has reportedly spent much of the past three years entirely re-architecting Junxure from the ground up to live as a cloud-native solution. That, out of the gate, will put AdvisorEngine into a more direct competitive position with the other leading adviser CRM systems, Redtail, Wealthbox and Salesforce, particularly given AdvisorEngine’s newly expanded capabilities when it comes to cross-platform integrations and workflow capabilities to function in the role of a modern CRM hub.

At the same time, AdvisorEngine CRM is just one part of a broader wealth management platform that AdvisorEngine has been building for years, as one of the early robo-advisers-for-advisers platforms that sought to position itself as a digital onboarding platform for advisers, which over time has expanded into performance reporting, billing and trading. That positions AdvisorEngine itself as more akin to an Orion or Black Diamond competitor, but unique in having its own CRM system, as Tamarac does.

Notwithstanding the connectivity between AdvisorEngine’s CRM and other systems, the company reports that Junxure-turned-AdvisorEngine CRM will remain available for sale on a stand-alone basis, separate from the broader wealth management platform. This allows AdvisorEngine CRM to compete even for advisers already using a competing portfolio management platform like Orion or Black Diamond, though one has to wonder if AdvisorEngine still hopes that the CRM system will become a gateway to its broader offering, which appeared to be its intention when it acquired Junxure in the first place.

Nonetheless, in an adviser CRM category that has seen remarkably little new competition for years despite becoming an increasingly essential system for financial advisers, it’s arguably quite healthy for a fresh competitor in the form of a relaunched and modernized Junxure, and AdvisorEngine appears hopeful about converting existing advisers with the rollout of dedicated migration support for advisers looking to make a switch. And given Junxure’s roots as a particularly deep system for building financial planning workflows, having been born from the founder of a financial planning firm, the relaunched AdvisorEngine may be of particular interest to planning-centric advisers looking for new solutions. At a minimum, though, the new AdvisorEngine CRM will put pressure on its competitors to continue to iterate their own features, which is a plus for the adviser community.

Over the past 20 years, the rise of the internet and then the smartphone led a wave of startups — robo-advisers — to make the case that consumers, especially among Gen X and Gen Y, would eventually want to eschew financial advisers altogether and just use technology to answer their financial questions. Yet in the years since, it’s turned out that financial advisers are still growing strong, while robo-advisers are struggling even as technology itself becomes ever more ubiquitous in our lives.

However, the fact that human financial advisers have retained such a human connection to their clients in an increasingly digital world doesn’t mean that every meeting has to be face-to-face, or that every communication has to be a phone call delivered by the advisers themselves. Instead, meetings have increasingly shifted from in-person to virtual, a trend accelerated by the pandemic, while communication has shifted from phone calls to emails and increasingly to text messages.

Simply put, a lot of clients just want to text their adviser. It’s a much easier way to answer quick questions and stay connected. This isn’t news to any of us, but as usual, compliance regulations have made this a challenge for advisers.

To address the emerging demand, back in 2017 Redtail launched a new offering called Speak. It allowed advisers who used Redtail CRM to text message with their clients and do so in a compliant way that ensures all client communications are archived so they can be subsequently reviewed for compliance purposes.

But as text messaging has evolved, so too have its use cases. In the early years, text messaging was primarily used as a simple person-to-person communication tool, for which alternative solutions like MyRepChat, which allows advisers to text clients directly from their existing smartphones/devices and have the communication archived for compliance, were often even more popular than the Redtail approach of routing text messages throughthe advisor’s CRM.

Now, though, text messaging is more than just a quick check-in communication tool. It’s also becoming a channel by which advisers may disseminate information, from sending systematized confirmations of upcoming meetings to sharing out a quick video of the adviser’s latest commentary on market volatility. That’s leading Redtail to expand the capabilities of Speak with more message templating capabilities for higher-volume use — a use case that isn’t well met with one-device-at-a-time approaches like MyRepChat — but it’s also now led Redtail to unbundle Speak from the rest of its adviser CRM platform.

Of course, Redtail Speak as a stand-alone text messaging solution for advisers will still integrate toRedtail’s own CRM system, and there are even rumors that it may integrate with other CRMs in the future to push text messaging from Redtail Speak into whatever CRM system the adviser is using.

Notably, though, Redtail Speak still operates on a more centralized system than the MyRepChat approach, as advisers send text messages from Redtail Speak directly either via their desktop, or soon with a separate mobile app, rather than using each adviser’s existing phone number. In fact, advisers will need to obtain a separate text messaging number for the firm to use with Redtail Speak, which also means giving clients yet another phone number to store and remember if they want to text with their adviser, though it’s not hard for clients to just add another number to their adviser’s contact record. On the one hand, that’s simply the trade-off for the more centralized one-to-many uses of having client service administrators use Redtail Speak to text meeting confirmations to clients. On the other, it means Redtail Speak will likely skew more toward the midsize-to-large advisory firm that tend to prefer to control their adviser-client communication channels more centrally in the first place.

In the longer term, the ultimate question is whether Redtail Speak can actually help bring advisers toRedtail CRM — as presumably Redtail’s primary goal is not to scale Speak itself, but to use it to introduce advisers to the Redtail ecosystem and attract them to Redtail from a competing CRM system. This, in turn, will raise questions of whether other CRM providers even want to open the door to integrations with Redtail Speak, or if in the end its unbundling will still leave it as a de facto Redtail-only integration because of the perceived competitive risk for other CRM providers. Ironically, though, having Redtail Speak remain a Redtail-only offering isn’t necessarily bad for Redtail, either; as long as Redtail Speak remains focused into the Redtail ecosystem, if competing CRM systems lack a similar offering, it may simply help Redtail retain its own CRM users instead.

The real question, though, will simply be how text messaging itself evolves in the years to come. The more it remains a person-to-person communication channel, the more advisers will likely skew to the more traditional text messaging approach and use tools like MyRepChat, whereas the more text messaging becomes a firm-to-client communication channel, the better positioned solutions like Redtail Speak will be for a one-to-many text messaging future.

For more than 30 years, advisers have had two primary choices regarding the channel in which they build their business: as an employee or as an independent. The employee model was largely the domain of national brokerage firms and bank/trust companies, while independents could choose to build under the umbrella of a broker-dealer if they were selling Finra-registered products, or as an independent RIA if they were solely giving advice or managing portfolios.

The caveat is that operating an independent business can still be aided by some operational resources to support particularly hard-to-handle issues like compliance, and can benefit from being aggregated with other advisers to gain economies of scale (e.g., when it comes to buying technology). As a result, independent advisers historically have been aggregated together under independent broker-dealers like LPL, Cetera or Commonwealth as their platforms.

The value proposition of the original independent-adviser aggregator is simple. The aggregator will provide options for advisers to outsource as much as possible, so that advisers can focus on serving their clients and adding new clients. And just as aggregators built in independent broker-dealers for decades, they are now increasingly appearing in the RIA channel as well, from a wide range of TAMPs to support networks like Dynasty Financial, Sanctuary and Steward Partners, along with even more independent networks like Garrett Planning Network, Alliance of Comprehensive Planners and XY Planning Network. The aggregators negotiate with all the vendors to get better pricing because of their collective size, and they may offer outsourced middle- and back-office services as well.

The more services that crop up for independent advisers, the more advisers are attracted to the independent channel, and the more aggregators show up to support independent advisers. The circle of life for advisers has shown little signs of slowing: A recent college graduate is lured into financial advice by the big brand of a national firm with an employee model. The adviser begins to have some success and realizes there are options for them to keep a larger slice of the revenue pie that they are generating, while having more choice and flexibility about how their clients are served. They begin the journey of going independent, and as the options proliferate, the promise of independence has never been stronger.

As of late, though, it seems as though a new option has sprouted up, particularly as the internet has made identifying and reaching niches a bit easier. It is Aggregator 2.0. Combining the value proposition of the original aggregator, with a focus on specific niches of advisers and creating community around that niche, these turnkey advice and planning platforms, or TAPPs, build a focused value proposition that allows them to peel more advisers away from the generic offerings of traditional aggregators.

This was highlighted most recently by the launch of Onyx Advisor Network. Founded by Dasarte Yarnway and Emlen Miles-Mattingly, Onyx aims to provide entrepreneurial support and community specifically to minority-led wealth management firms. After getting hard-earned lessons from building successful minority-owned practices on their own, they saw the need for a platform that helped make the road a bit easier for others.

Similar to other aggregators, Onyx has already begun to negotiate tech partnerships, in its case with Wealthbox, MoneyGuide, RightCapital, Message Watcher, Synergy RIA Compliance and notable new custodian Altruist. Additionally, it is offering investment management in partnership with Vanguard.

Yet because such technology tools are available from a number of platforms, Onyx is aiming to differentiate on two distinct points. Instead of a traditional basis-points sharing fee model, it has a flat monthly subscription fee for access to the platform. And it aims to provide a meaningful community experience to minority-led founders, which is particularly lacking within most other platforms, where advisers of color are sucha minority that it’s difficult for them to find community among other advisers within the aggregator.

Dasarte and Emlen have both built successful media arms as a way of growing their practices. Creating content inevitably leads to creating community, and Dasarte has been serving as the head of community for Altruist for over a year. This is a crucial piece of their vision for success, as in a competitive space for adviser support platforms, figuring out the distribution — how to reach prospective new advisers to join in a cost-effective manner — is still a real challenge.

With the growth of other adviser networks under the Aggregator 2.0 model in recent years, though, it appears there is still a lot of room for more TAPPs to form to each serve their own respective niche markets, which positions Onyx well, given the unique needs and challenges of the adviser segment it’s aiming to serve.

One of the most appealing aspects of becoming an independent RIA is that financial advisers no longer have to answer to a home office in selecting their technology, and instead are able to choose from whatever they wish from the available landscape of more than 300 adviser technology solutions, and assemble their own personalized “best-of-breed” approach by picking the ideal software for each key category of their tech stack.

The caveat, though, is that with growth in adviser technology over the past decade, the choices have shifted from plentiful to nearly overwhelming, which at worst leads to a form of analysis paralysis in trying to make a selection, and even in the best of circumstances requires advisers to do more vendor due diligence and work to try to figure out how to weave the technology together than most advisers are comfortable with (having gotten into the business to serve clients, not vet APIs).

Among the very largest of independent RIAs, there is an emerging trend of hiring a chief technology officer, whose job is to oversee the firm’s entire technology stack and ensure it comes together. Successfully running technology at any business conjures up images of a duck on a pond — calm and collected on the surface, but under the surface their feet are churning like crazy. Yet the reality is that few firms short of the multi-multibillion-dollar mega-RIAs have enough economies of scale to afford a full-time executive-level CTO hire.

To fill the void, Doug Fritz of F2 Strategy has now launched an outsourced chief technology officer offering, aiming to help midsize-to-large RIAs solve their technology issues. This means a focus not only on helping to select software partners from the sea of options but ensuring that everything is connected properly and running efficiently, while potentially building some of the connective glue layers that advisers need help with so as to make it all work together.

Notably, staffing up for chief technology officers — even and including outsourced chief technology officer offerings — is still cost- and labor-intensive, as F2 Strategy now has 23 full-time staffers to support just 16 full-time and another 30 part-time engagements with independent advisory firms. Nonetheless, relative to the cost of a full-time skilled and experienced chief technology officer — which can easily run an advisory firm $200,000-plus in compensation — the F2 Strategy offering is very well positioned for the 700-plus advisory firms with “a billion or few” of assets under management that have the technology complexity to necessitate a chief technology officer but lack the depth for a full-time hire.

Which means at this point, the biggest question for F2 Strategy may simply be whether the firm can cost-effectively manage to hire up enough of its own outsourced chief technology officers to fulfill the adviser demand?

In a world where most financial advisers got into the business to help their clients — not to find and vet technology vendors — one of the most popular questions in the hallways of financial adviser conferences is, “What do you use?” In essence, by relying on the wisdom of the crowd — whatever is popular must implicitly be at least pretty good, otherwise advisers would be finding some alternative solution and choose that one instead — advisers can try to shortcut the process of figuring out which adviser tech tools they should be considering for their own firms, with the added benefit of asking colleagues and peers about their own experiences using the technology, such as “Do you really like it?”

To meet the interest of financial advisers in knowing what other advisers are using, over the years a number of different adviser technology studies have emerged, which survey advisers to identify what’s popular, what’s well-liked, and where advisers are looking to make changes, including various trade publications like InvestmentNews and Financial Planning, and industry experts like Joel Bruckenstein of Technology Tools for Today (T3). The caveat, though, is that existing industry studies tend to struggle with their sampling approach to data collection, either not collecting enough data across the industry channels as over- or under-sampling any particular channel can quickly lead to distortions in the results, or utilizing open survey links that end up being shared by the vendors to their own users to drive more participation, effectively turning the survey into a “turn out the vote” exercise for the vendors rather than obtaining a representative sampling.

To fill the void, last year Kitces Research announced the launch of a new AdvisorTech study, with a specific focus on using a more robust sampling method without shareable survey links to help the industry gain a better understanding of which technology tools were really the most popular and well-liked and not just which vendors were most effective at promoting the survey itself. The survey has a particular focus on better understanding the adviser adoption and satisfaction trends in the independent adviser marketplace — as ultimately, it’s the independent advisers who can fully control their own technology decisions, which means what independent advisers are buying, or not, is arguably the strongest signal of which technology is really connecting with the end advisers themselves, or not.

Now, the results are out for the Kitces Research on Independent Advisor Technology. Overall, the study reveals that the adviser technology marketplace is remarkably efficient, in that the technology that advisers deem most important, for which there is the greatest demand, is also consistently the technology that advisers are most satisfied with. This implies that companies really aredoing a good job of iteratively improving the tools in the greatest demand until advisers are reasonably happy with the results.

At the same time, though, the Kitces AdvisorTech study does show a number of notable gaps in emerging new categories where there’s growing adviser demand, including data gathering, ongoing plan monitoring, more specialized planning tools (e.g., for tax planning or retirement income planning), fee billing software and trading tools, where there’s either a dearth of high-quality options, creating an opportunity for a first-mover to quickly gain market share, or where there are only one to two currently viable options, suggesting that companies in those categories will see rapid growth in the years to come.

In addition, the new Kitces AdvisorTech research also reveals which established players continue to maintain and grow market share despite new competition (e.g., Orion, Riskalyze, Redtail and eMoney), along with the incumbents that are beginning to lose market share to newcomers (e.g., Morningstar and MoneyGuide), and the fast-rising newcomers that are making real inroads with advisers (e.g., Holistiplan, RightCapital, Wealthbox, YCharts and Advyzon).

In the end, the reality is that advisers don’t change technology very often. Even among high turnover categories, the Kitces AdvisorTech study shows barely 1-in-10 advisers expect to make a software change in the coming year. This means that changes in leadership in the various AdvisorTech categories will only change slowly. On the other hand, the fact that change happens slowly, but persistently, makes it all the more valuable to see which adviser technology tools are gaining momentum among the independent advisers who have the ability to choose for themselves what’s really worth keeping, and what’s deemed to be worth making a change for.

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation.

So what do you think? Will advisers gain enough comfort with crypto assets to adopt new custodial relationships just to give clients more access? Did Wealthfront miss the boat by not packaging its direct indexing platform for advisers from the start? Will advisers make the implementation of wills and trusts part of their standard estate planning offering to clients? And can AdvisorEngine CRM really capture market share away from Redtail and Wealthbox with a deeper focus on building adviser workflows?

Disclosure: Michael Kitces is the co-founder of XY Planning Network, which was mentioned in this column.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

Kyle Van Pelt is the executive vice president of sales at Skience. You can connect with Kyle Van Pelt via LinkedIn or follow him on Twitter at @KyleVanPelt.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound