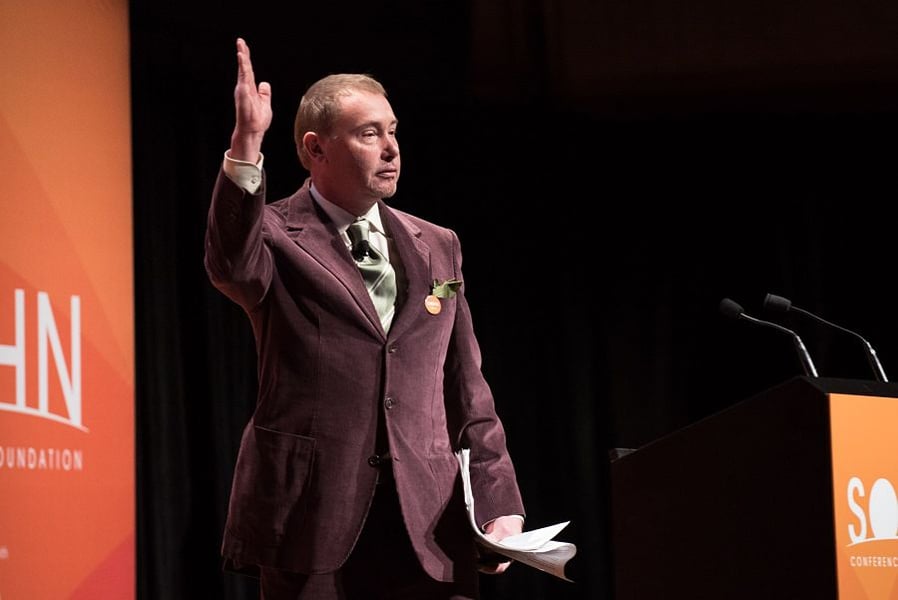

Jeffrey Gundlach may be on the move.

The Doubleline Capital CEO tweeted an invitation for real estate agents in “low tax, well governed” U.S. states to call him, as he openly pondered leaving his Los Angeles base.

In a series of tweets, sent late Saturday on the West Coast, the billionaire investor said that public figures including Elon Musk “are leaving California to escape incompetent governance.”

Like many states in need of more revenue due to the economic ravages of the global pandemic, California is considering raising taxes on its richest residents. Democratic lawmakers in Sacramento have proposed increasing the top rate to 16.8% from 13.3% for incomes over $5 million, with changes retroactive to Jan. 1.

This month New Jersey lawmakers approved raising the tax rate to 10.75% from 8.97% for those with incomes above $1 million, and there’s a ballot measure in Illinois calling for higher levies on the wealthy. Meanwhile, states such as Florida, which has no state income tax, are seeing increased interest from hedge fund managers and other wealthy people to relocate.

Gundlach wouldn’t be alone in departing California. Parts of Silicon Valley have moved to Nevada and Texas as they embrace work from home. Canyon Partners, the $24 billion hedge fund firm, is considering setting up a new office in Texas next year to flee what its leaders see as the high taxes, congestion and fire risks of Southern California, Bloomberg reported Friday.

“I get multiple queries each week from people looking to leave California, which is an uptick on the past,” said Robert Wood, managing partner of Wood LLP, a law firm focused on taxes. “Some cite the proposals, and some also note the already tough taxes.”

[More: Gundlach predicts Trump will win]

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound