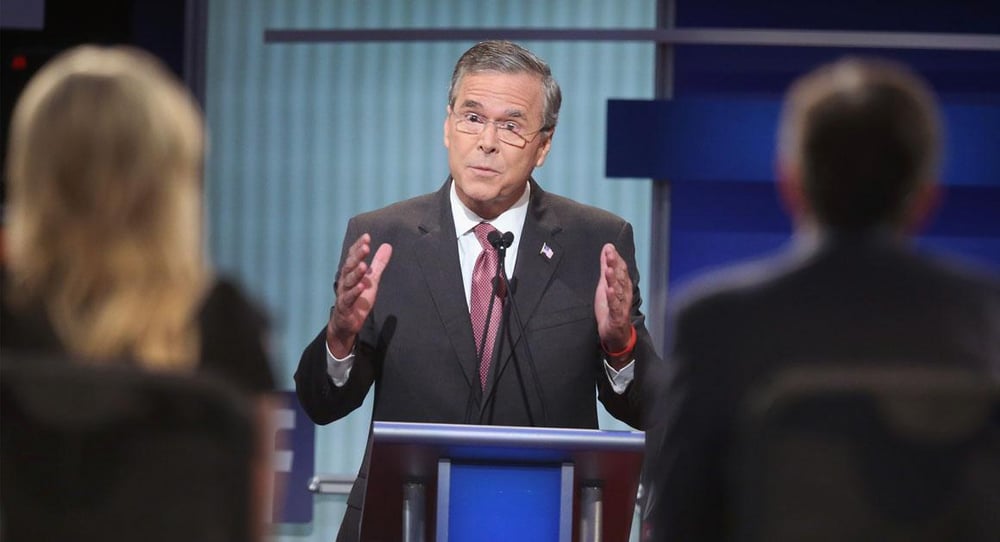

Former Florida Gov. Jeb Bush would trim the capital gains tax, lower individual and corporate rates and cap deductions as part of a tax plan he asserts would spur economic growth.

Mr. Bush, a Republican candidate for president, outlined his proposal on his campaign website and in an appearance Wednesday morning on CNBC. He was slated to release details later Wednesday.

Under Mr. Bush's plan, interest income, dividends and capital gains would be taxed at 20%. That would involve a shift from the current way interest is taxed as earned income and lower the top rate for dividends and capital gains from 23.8%. Mr. Bush would eliminate the 3.8% surcharge on investment income above certain levels that was imposed by the health-care law.

He would

streamline seven individual tax brackets to three: 28%, 25% and 10%. He also would reduce the corporate tax rate to 20% from 35%.

TAX DEDUCTIONS CAPPED

To help finance those cuts, he would cap tax deductions, other than those for charitable giving. He also would eliminate so-called “carried interest” that allows private equity and hedge fund partners to pay capital gains taxes rather than ordinary income taxes on their share of fund profits.

An overhaul of the tax code would help increase economic expansion to Mr. Bush's goal of 4% annually, he said.

“A high growth strategy requires first and foremost dramatic reform of our tax code,” Mr. Bush said on

CNBC's Squawk Box. “We need to increase productivity to create higher wages, and this plan would do it.”

Mr. Bush is among a handful of the more than 20 presidential candidates who has

put out a tax plan, according to the Tax Foundation.

Republican

Florida Sen. Marco Rubio would eliminate taxation of capital gains and dividends. Another Republican contender, Sen. Rand Paul, R-Ky., would set investment taxes at 14.5%, as part of his flat-tax plan.

CLINTON WOULD RAISE CAP GAINS

The Democratic frontrunner, Hillary Rodham Clinton, would

increase the capital gains rate for investments that are held for short periods of time.

The candidates aren't likely to flesh out too many tax details during the campaign, but how much they talk about the issue may indicate how hard they'll push for changes to the code if they're elected.

“The priority of tax reform could be more important than the underlying substance,” said Marc Gerson, a partner at the law firm Miller & Chevalier.

Major tax reform likely will have to wait until after the election, in which several Republican members of the Senate Finance Committee are in play, in addition to the presidential vote.

“It makes modest tax legislation challenging [in 2016],” said Mr. Gerson, a former tax counsel for House Ways & Means Republicans. “Tax reform would be even more difficult.”