When it comes to collecting Social Security benefits, married couples enjoy certain advantages that aren’t available to their single counterparts. To maximize their benefits, for example, each spouse can claim at different times. They may also be eligible for spousal benefits.

Faced with many options, couples are often left with the overwhelming task of figuring out the best way to boost their retirement benefits. In this client education article, InvestmentNews explores the most effective Social Security strategies for married couples. We will discuss how each approach works, and the different factors spouses need to consider to get the most out of their retirement payouts.

If you and your spouse are nearing retirement age and working out ways to maximize your Social Security benefits, this guide can help. Financial advisers can also share this article with their clients to help them make informed decisions on their financial future.

Read on and find out how thoughtful planning can enhance your retirement income and provide you with financial security for the years ahead.

Spouses are among the many beneficiaries of Social Security. These include stay-at-home partners and those who haven’t contributed to the program. In some situations, even ex-spouses may be eligible to collect spousal benefits. Social Security spousal benefits also apply to same-sex marriages in all states.

To be eligible, spouses must meet these criteria:

Nonworking spouses caring for a qualifying child are often eligible to receive benefits before reaching 62 years old. The marriage requirement may also be waived in this situation. According to the Social Security Administration (SSA), a qualifying dependent is someone who is under 16 years old or receives Social Security disability benefits. They should also be the married couple’s biological child.

Depending on when they start receiving their benefits, spouses can claim an amount equal to up to 50% of their partners’ Social Security benefits. They can qualify for the maximum payout if they start receiving spousal benefits at full retirement age (FRA). This is regardless of whether their spouse delays collecting payouts past FRA to increase their retirement benefits.

If they decide to claim retirement income early, there are certain drawbacks. Social Security spousal benefits are permanently reduced by 25/36 of 1% each month before reaching FRA. This applies if the beneficiary reaches full retirement age within 36 months.

But if they retire more than 36 months before FRA, their benefits will be reduced by 5/12 of 1% for each month exceeding this period.

Widows and widowers also benefit from Social Security for married couples. They are eligible for survivor benefits equivalent to up to 100% of their spouse’s retirement benefits. This is regardless of whether their spouse dies before reaching normal retirement age.

Learn more about how spousal benefits work in this guide to Social Security benefits for nonworking spouses.

There are several factors that come into play when determining the maximum Social Security benefit married couples can receive. These include each spouse’s:

According to the SSA, those who retire at full retirement age in 2024 can claim a maximum retirement income of $3,822. Those who start collecting benefits at 62 years old can receive up to $2,710. Those who wait until age 70 to claim retirement benefits can receive a maximum benefit of $4,873.

These retirement payouts, however, only apply to retirees who paid Social Security taxes for at least 35 years and earned at least the maximum income covered by the program. In 2024, the maximum income covered by Social Security is $168,000. Retirees who earned less than this amount would get lower than the values above, depending on their earnings record.

Married couples can get an accurate estimate of their retirement benefits by using the SSA’s online benefits calculator and spousal claims calculator.

Learn more about how Social Security benefits work in this guide.

Because each spouse comes with their own unique circumstances and financial situation, there’s also no one-size-fits-all approach that suits every situation. The Social Security strategies for married couples we will discuss in this section are general courses of action. It’s still best for couples to consult an experienced financial advisor to find a strategy tailored for their long-term financial goals.

Here are some general tactics married couples can use to maximize their Social Security benefits:

Under this strategy, the lower-earning spouse starts claiming benefits between age 62 – the earliest possible – and normal retirement age. The higher-earning spouse, on the other hand, delays receiving benefits until age 70 to collect the highest Social Security benefits possible.

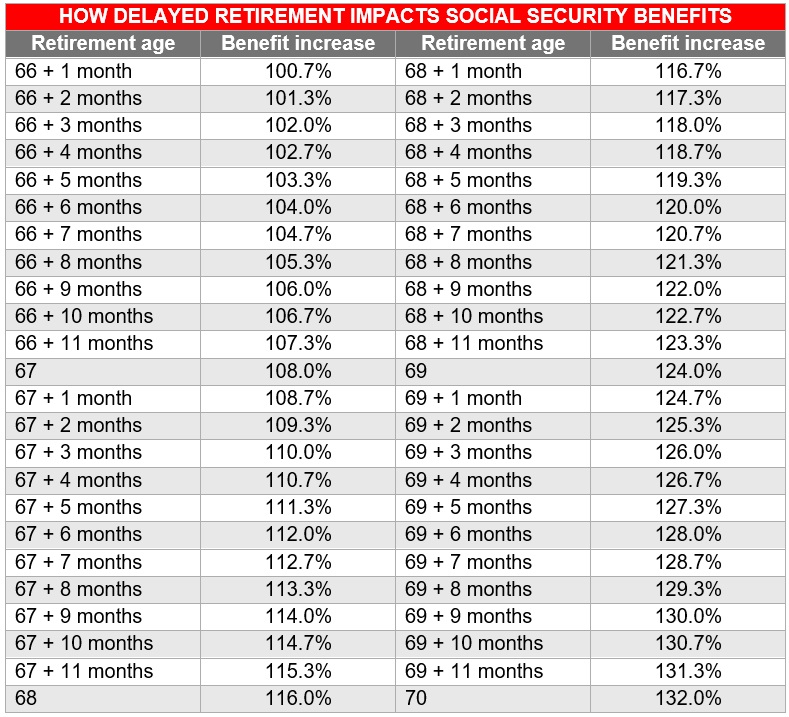

According to SSA rules, beneficiaries can earn an additional 8% in benefits for every year after full retirement age. This means that those whose FRA is 67 can earn an additional 24% in monthly retirement benefit by holding off claiming until 70 years old. For those whose FRA is 66, they can earn a 32% increase in monthly payouts.

This benefit extends to Social Security survivor benefits. If the higher-earning spouse dies after age 70, the lower-earning spouse can take the deceased’s benefits, while dropping their retirement or spousal benefits.

As discussed, married couples can get a significant boost in their Social Security benefits by waiting until age 70 before collecting.

Here’s how much retirement benefits can increase for every month a person delays claiming until age 70, according to the SSA.

This is among the top Social Security strategies for married couples who have a good chance of beating the average life expectancy. This may also be a good tactic for those who enjoy working and have employment opportunities beyond full retirement age.

Those who claim early but continue to work are subject to the retirement earnings test. Find out how the Social Security earnings test works in this guide.

Individuals born on or before January 1, 1954 are eligible to file a restricted application upon reaching retirement age. This allows them to claim a spousal benefit tied to the lower earner’s benefit while deferring the higher earner’s benefit through delayed retirement credits.

This Social Security strategy suits married couples where both spouses have large earnings records and are financially stable enough to do without the higher benefits for a few years.

Previously, married couples could claim Social Security spousal benefits while allowing retirement benefits to grow by using the “file-and-suspend” approach. Under this strategy, the working spouse files for retirement benefits upon reaching FRA, then voluntarily suspends their retirement payouts. By doing so, the nonworking spouse continues to receive spousal benefits while the working spouse’s retirement benefits grow.

The Bipartisan Budget Act of 2015, however, abolished this loophole. At present, when someone files for Social Security benefits, they are considered to be filing for all benefits they are entitled to receive. The SSA assumes that an applicant is filing for both retirement and spousal benefits and pays out the higher amount.

Before choosing Social Security strategies, married couples should consider a range of factors that may impact their retirement decisions. These include:

Couples with enough retirement savings may be able to delay Social Security benefits to boost their monthly payouts. One strategy that couples can employ to bridge the gap is to tap into their retirements savings such as their 401(k) and individual retirement accounts (IRA).

A married couple’s current health condition and medical histories are important factors to consider when evaluating Social Security strategies. According to SSA data, a 65-year-old today has a life expectancy of around 19 years for men and 22 years for women. The department also has a life expectancy calculator, which provides an estimate based on age and gender.

Married couples who are similar in age and with similar benefits can maximize their retirement income with one spouse claiming early and the other delaying benefits. This way, they can use one spouse’s retirement income while the other accrues. This can also increase future survivor benefits.

Couples who decide to claim but stay in the workforce or plan to work are subject to the retirement earnings test and have their benefits temporarily reduced.

For those under FRA for the entire year, the SSA deducts $1 from the retirement benefit for every $2 earned above the annual income limit. For those reaching FRA within the year, the SSA deducts $1 in benefits for every $3 earned exceeding a different limit. Married couples can recoup most or all of the withheld benefits once they reach full retirement age.

There are three ways for married couples to file for personal and spousal Social Security benefits:

Applicants must be within three months of their 62nd birthday. If filing online, applicants must tick both the retirement and family benefits boxes.

For those applying for personal retirement benefits, the SSA automatically considers whether they’re also eligible for spousal benefits. It’s important that married couples consider the timing of the application as it will trigger the personal and spousal benefits at the same time. For those who qualify for both, the department sends the larger of the two benefits.

Those filing for spousal benefits may need to provide a copy of their marriage certificate or divorce decree to be eligible. The SSA instructs applicants, however, not to send any documents unless requested.

Visit our Retirement Planning News Section for more information about Social Security benefits. Be sure to bookmark this page to access breaking news and the latest industry updates.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound