In discussions about investing, the likely investment that comes to mind is shares of stock. As top-of-mind as stocks are, they’re only one of the many asset classes that you can invest in. Many beginners in investing eventually discover other assets like real estate, commodities, annuities, and precious metals.

But in this article, we focus on another more common and viable investment: bonds. They’re different from stocks that give investors a stake in the company they bought the stocks from. Instead of representing a share in the company the way stocks do, bonds are representations of the bond issuer’s indebtedness to those who bought their bonds.

Put in a simpler way, a bond is essentially money that a company borrows from investors, with the intent to pay back the money to those who bought bonds when they mature. Given this arrangement, are bonds worth investing in? What are the advantages and the risks of investing in bonds? In this guide about investing in bonds for beginners, InvestmentNews provides answers to these questions and more. Let’s get into it.

In a nutshell, bonds are considered loans from investors like you, to entities like corporations, government agencies, or other organizations that issue the bonds. In exchange for the money you loan them, the bond issuer promises to give you interest payments. What’s more, the bond issuer repays the principal amount when the bond matures.

This makes most bonds function as fixed income, short-term investments, which means that investors get the promise of a fixed amount of earnings at intervals set throughout the term of the bond. You can think of bonds as an IOU from the entities that you buy them from. When the term ends or reaches its maturity date, the bond issuer must pay back their “loan” from you in full.

Bonds should make up only a small portion of your portfolio. Check out this guide for new investors and you’ll see why.

When investing in bonds, there are terms investors should be familiar with, including:

This is a type of bond that gives the issuer the right to pay the bondholder back earlier than the full term of the bond.

This is the annual interest rate paid on the money, which is equal to a percentage of the bond’s face value. Typically, the coupon is paid out semi-annually.

This is the amount the bond will be worth on its maturity date and is sometimes referred to as the bond’s “par value”. The face value is often used to determine the amount of the interest payments investors will receive until the bond matures. In most cases, bonds are issued in multiples of $1,000.

As opposed to the usual bonds that have fixed income rates, this is a bond with interest payments that change according to other short-term benchmark rates. The rates may even change due to the price of a commodity.

This is the specific date on which the money must be repaid. A bond’s maturity date is set at the beginning of its term, which can be from 1 day to 100 years. In most cases, long-term bonds have a maturity date of 30 years.

This is the highest amount that bond investors are willing to pay for an existing bond.

The opposite of the callable bond, the put bond gives the investor the option or right to ask for repayment of the principal, which essentially cancels the loan.

The return an investor can expect to get from the interest on the bond.

These are bonds that do not give any periodic interest payments. The cash return from these bonds is paid out at the bond’s maturity instead, providing higher yields.

Those investing in bonds may be surprised to discover that there are several types, all with different features and benefits. Here are the most common types of bonds:

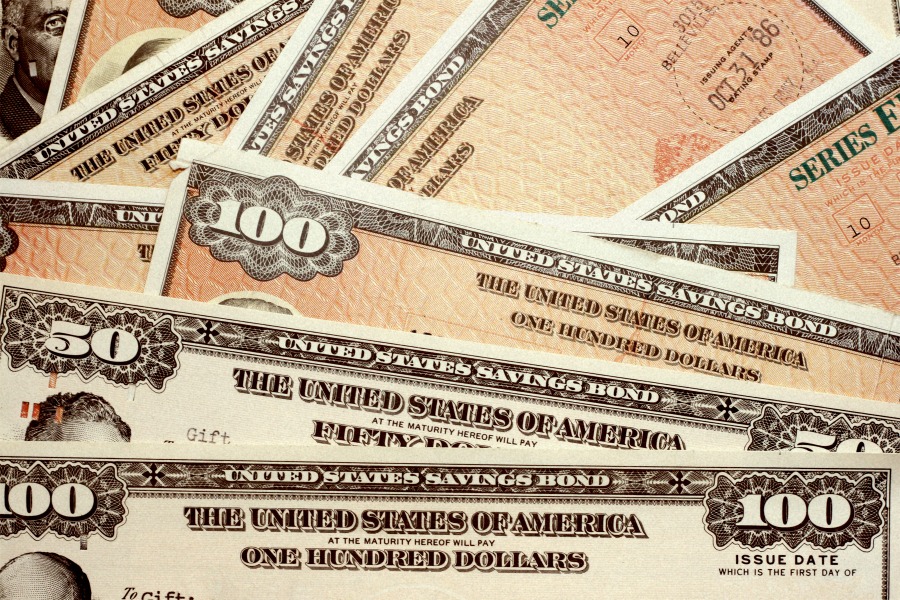

These are probably the most common type of bonds and represent indebtedness of the US government. Also called treasuries since they are issued by the US treasury department and sold to investors as a means of funding government expenses.

Treasury bonds are considered among the safest investments, as they are low-risk investments backed by the US government itself. With treasury bonds, investors are shielded from the impacts of even the most extreme events like war, recession, or even inflation risk. The only drawback to treasury bonds is that investors must pay federal taxes on the interest income, but they are exempt from paying state and local income taxes.

Agency bonds are those issued by government-sponsored agencies or federal departments outside of the treasury for a public purpose. Entities like the Federal Housing Administration (FHA), Freddie Mac and Fannie Mae are examples of organizations that issue agency bonds to raise funds for their projects.

On the private sector side, there are corporate bonds. Corporate entities issue bonds like this to fund a large capital investment or a business expansion. These bonds are subject to federal and state taxes.

The risk associated with these bonds depends on the issuing company’s financial outlook, so the risk varies across different corporate bonds. This varying risk is one of the main differences between bonds and other kinds of assets like stocks.

Unlike investing in stocks, investing in bonds doesn’t come with ownership rights. A company’s growth doesn’t necessarily translate to higher earnings for bond investors. On the other hand, if the company stays current on its loan and continues to pay your bond interest, any positive or negative impacts do not directly affect investors unless the company goes bankrupt.

Also known as “munis”, these are bonds issued by states, cities, counties, and other similar government entities. The purpose of issuing municipal bonds is to raise funds for public projects. Municipal bonds can be issued so cities can build new schools, improve highways, or install new sewer systems.

Most munis are sold in minimums and increments of $5,000. Munis can be good investments, as some of them are exempt from paying federal taxes. This means investors can have more money in their pockets come maturity date, as they won’t have to pay federal taxes on earnings or the principal.

In some instances, the munis also feature an exemption from city and state taxes, if the bond investor lives in the city or municipality that issued the bonds.

Here’s a video from Charles Schwab that gives more basic information about bonds:

Waiting for the bond to reach its maturity date and getting the money back is not the way your bonds earn. Investors can make more money on bonds in two ways:

By their very nature, bonds will pay you the interest on the principal amount throughout their term until the maturity date. By making your initial investment and giving it time, you can regularly collect interest payments until the bond matures.

Not all who invest in bonds keep their bonds until maturity. As an investor, you can choose to sell your bond well before reaching its maturity date. When you sell a bond for more than you paid for, that’s known as a capital gain.

So, assuming you purchased a bond for $1,000 and then resold it for $2,000 – the $1,000 difference is your capital gain. But should you sell it at a time when your bond’s price is lower than what you paid for, that is considered a capital loss.

As with any investment, bonds have their share of advantages and disadvantages. To help you become better informed about bonds, here are their pros and cons:

For many investors, especially those who lean towards more liquidity in their investments, regular interest payments can be a huge attraction. Bonds can be particularly attractive to retirees, who need other income sources to bolster their other retirement income sources. Pensions and social security may simply not be enough to provide for their needs, so bonds can fill that gap.

In any discussion of stocks and bonds, it’s true that bond prices can fluctuate wildly on occasion, but these investments are more stable overall, compared to stocks. By adding bonds to a portfolio, investors can lessen the amount of risk and volatility in their portfolios in the long run.

“While bonds can vary dramatically in their characteristics and performance, the bond market as a whole tends to offer lower downside risk than the stock market, including during recessions,” said Cyrus McMillan, CFA and portfolio manager at Trillium Asset Management. “A diversified portfolio of high-quality bonds, backed by thorough risk management processes, is typically well-suited to protect investment capital in all phases of the economic cycle.”

When it comes to interest rates, bonds have an inverse relationship with the Federal Reserve’s interest rate. This means when interest rates rise, bond prices fall and vice versa.

Due to this relationship with interest rates, unexpected spikes or falls can create temporary instability in the bond market.

Investors can lose out on major earnings if they invest only in bonds.

As cliché as it sounds, the old saying “never put your eggs in one basket” applies to investing in bonds and stocks. Since bonds can offer regular income and good returns (depending on the type of bonds), it seems logical to invest in them exclusively. Investors should know that such a practice can make them lose out on major returns.

A bond investor only gets what’s promised and not much more. If, for example, you chose to buy bonds in companies like Apple, Microsoft, or Nvidia – then held these to maturity, the best you’ll receive are the guaranteed interest payments and the principal amount upon maturity.

But if you invested in even some of their stock – like in Nvidia for instance – you would have seen massive returns from Nvidia stock that bonds may not hope to match, even if it’s a high yield.

Furthermore, according to McMillan, “while bonds can offer investors a stable source of investment income, they tend to yield lower returns than riskier asset classes such as stocks. From an ESG perspective, bonds also offer limited opportunities to engage with their issuers, while stock investors can use the shareholder advocacy and proxy voting processes to positively impact a company’s ESG practices.”

If you search for individual bonds to invest in, you may notice that each bond has a rating. Bonds will have ratings provided by at least one of three independent bond-rating agencies:

To rate bonds, these agencies make a thorough review of the issuing company or entity’s financial statements. These agencies can inspect any issuing body to rate its bonds, whether it’s a municipality, the US treasury, or an international corporation.

You may notice different ratings for bonds; these are typically represented by three letters and a plus or minus sign. Here’s what they mean:

These bonds have high creditworthiness and are highly recommended by the three bonds rating agencies. Investment-grade bonds will have ratings like:

Investment-grade bonds often see their yields increase as ratings decrease. US Treasury bonds are one of the most common triple-A rated bonds.

Also called “junk bonds”, these bonds will have ratings like:

In some instances, these agencies will give a “not rated” status to some bonds. While these bonds with unfavorable ratings have liquidity risks, they may still attract investors seeking high yields.

Investment-grade ratings mean the bonds have less chance of defaulting while non-investment grade is for bonds that have a high chance of defaulting.

Junk bonds are the most at risk of default, but ironically provide higher yields. While it sounds tempting, investors should think twice about junk bonds. There’s a real chance of not receiving interest payments, and worse, losing the principal amount if you invest in them.

There is no specific amount of money that you should invest in bonds, but what is important is allocating the right proportion of your money into bonds. “While a portfolio containing 60% stocks and 40% bonds is a common choice, your optimal bond allocation can only be determined in the context of your unique financial situation and the prevailing macroeconomic environment,” McMillan said.

“Any allocation to bonds should be backed by a process for analyzing the risk profile of specific bonds and managing the target characteristics of your bond portfolio.” If, as a beginning investor, this proves difficult or complicated, seek the advice of a finance professional.

For beginners, investing in bonds is safer than investing in stocks and can give you a regular, fixed return. Bond funds are even safer, since they’re a lot like mutual funds. However, many financial experts agree that bonds should only be a small part of a more diverse investment strategy. When considering bonds, check their credit rating, maturity date, and most crucially, think about your investment goals to decide if they have a place in your portfolio.

If you’re keen on investing in bonds and making it part of your portfolio, check out our directory of award-winning financial advisors who can help you with this and other investments.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound