One of the biggest misconceptions when it comes to Social Security is that if you choose to claim early, then you’re stuck with that decision. Certain situations, however, allow a change of heart, even after you’ve started receiving the benefits.

In this article, InvestmentNews will discuss the circumstances where you get a chance at a Social Security do-over. We will explain the rules and how reversing your decision can impact your retirement income. We also talked to a Social Security expert who shared her views on why people change their minds.

If you regret the timing of your retirement claiming decision, then you’ve come to the right place. Read on and find out how a do-over of your Social Security benefits can work for you in this guide.

When it comes to claiming Social Security, the timing of your decision determines how much your monthly payments will be. Claim early and you can see your retirement checks reduced permanently. Wait past full retirement age (FRA) and you can reap the benefits of delayed credits.

If you file for retirement and regret it later, you may get a chance to undo your decision. This, in a nutshell, is how a Social Security do-over works.

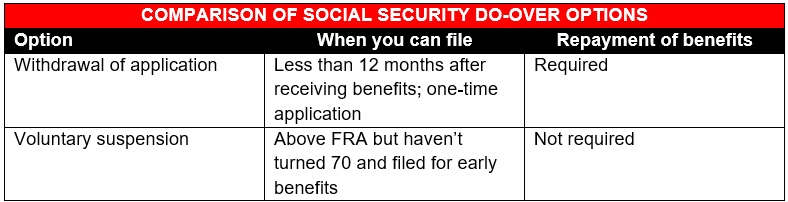

According to Martha Shedden, president and co-founder of the National Association of Registered Social Security Analysts (NARSSA), retirees have two do-over opportunities once they start collecting benefits.

The Social Security Administration (SSA) imposes two conditions that can make you eligible to withdraw your retirement benefits:

“[This] option is available within the first 12 months after an individual's application for benefits has been approved,” Shedden said. “Canceling or withdrawing the application during this time is known as ‘withdrawing an application’ and can only be done once.”

If you meet these conditions, you can withdraw your benefits as if you had never claimed them. You can then file for Social Security later when the monthly payments are larger. But this strategy comes with a caveat. You must pay back all the benefits you received, including those of your spouse or any family member collecting benefits on your earnings record.

This Social Security do-over option becomes more complicated if you’re already enrolled in Medicare. Because the premiums can no longer be deducted from your retirement benefits, you must pay them out of pocket. More details on this later.

What makes withdrawal of application an unappealing option for many is the amount to be paid back. Apart from your own benefits, you will need to repay those of your spouse and other dependents. You’re also required to pay back money withheld from your account, including Medicare premiums and taxes. All these must be paid in one lump sum.

Let’s say you have been receiving $2,000 per month in retirement benefits in the past 10 months. During this period, your spouse has also been receiving spousal benefits, which is half of your benefit amount. If you decide to get a Social Security do-over, you will need to shell out at least $30,000 to give back to the SSA.

Learn more about how Social Security works in this guide.

If repaying retirement benefits isn’t financially viable, you can choose to suspend your monthly payouts. This option doesn’t require you to repay anything, but you must meet these criteria:

“Voluntary suspension is used if an individual claimed early but now has the financial ability to do without their Social Security for up to three years,” Shedden said. “By suspending benefits, the individual’s benefit amount is then eligible for monthly delayed retirement credits up to the age of 70.”

Per SSA’s rules, your benefit increases by 0.66% for each month you postpone claiming past your full retirement age. Calculated annually, the rate is 8%. Depending on the year you were born, you can earn credits equivalent to 124% to 132% of your benefits if you wait until 70. This is on top of any cost-of-living adjustment (COLA) increase.

If you choose this Social Security do-over option, your benefits will stop the month after you make the request. Any benefits based on your earnings record, however, will also be suspended, including those of your spouse and other dependents. Divorced spouses aren’t covered by this rule.

You can restart your benefits anytime, with the corresponding increase in payouts. If you don’t and you turn 70, your monthly payments will resume automatically with your earned credits.

Here’s a summary of how these two do-over options compare.

Find out how early retirement affects your Social Security benefits in this guide.

There are several reasons that might prompt you to rethink your decision to claim Social Security benefits. These include:

Shedden added that the biggest consideration when withdrawing an application would be anticipated changes in one’s income. These situations include:

For voluntary suspension, Shedden said that the biggest reason would be that “they have the financial resources or are working again and are able to stop their benefit payments for a number of months or years up to age 70 to increase the benefit amount.”

Withdrawing or suspending your retirement benefits doesn’t impact your eligibility for Medicare. But since the SSA takes out Medicare premiums from your monthly checks, it’s important that you know how much exactly is being withheld. Once you decide to get a Social Security do-over, you will need to pay for these premiums yourself.

If you’re withdrawing benefits because you’re rejoining the workforce, you will also want to evaluate your employer-provided healthcare coverage. Consider how comprehensive the plans are and how much premiums cost. Compare these with those from Medicare. It makes sense to pick the coverage that best suits your needs.

There are additional factors to consider if you also choose to withdraw your Medicare benefits:

In addition, withdrawing from Medicare Part A or Part B can affect your Part C (previously called the Medicare Advantage plan) and Part D coverage (prescription medication):

Check out this guide to find out how to restart your Social Security benefits.

If you’re planning a do-over of your Social Security benefits, there are certain steps you must follow:

Once approved, you have 60 days to cancel your withdrawal. After this, you will lose all retirement benefits for the period covered in your application.

According to the SSA’s website, you can make a request for voluntary suspension of your benefits by informing the agency “orally or in writing.”

Some points to consider:

Another way to get the payouts you might have missed is by claiming retroactive Social Security benefits. Find out how this strategy works in this guide.

The decision to withdraw or suspend Social Security benefits requires careful planning and preparation.

“Each individual situation is very different, but a do-over should be carefully analyzed using software to understand how much it will affect their lifetime and annual/monthly benefits to make sure it is really the right choice,” Shedden said. “Either of the two do-overs allows retirees to increase their ultimate lifetime benefit amounts by either filing using a different strategy or stopping payments to take advantage of delayed retirement credits being added to benefits.

“That’s why it’s important to be informed and to understand the rules that affect you and your family, so that you are confident that the do-over is the best economic decision for you.”

Given the complexities of a Social Security do-over, it’s best to work with an experienced financial advisor who specializes in retirement planning. If you want to find one, our Best in Wealth Special Reports page is the place to go. Recently, we unveiled the five-star winners of our Top Financial Advisors in the USA awards. By partnering with these industry experts, you can be sure that your financial future is in good hands.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound