If you started claiming retirement benefits but have plans to continue working, it’s important that you understand how the Social Security earnings test can affect your payments. Also called retirement earnings test (RET), this test determines how much your benefits will be reduced if your income exceeds a certain threshold before you reach full retirement age (FRA).

In this client education article, InvestmentNews sheds light on this commonly misunderstood aspect of Social Security benefits. We will explain how the earnings test works, how it applies to your situation, and what steps you can take to maximize your retirement benefits. Financial advisers can share this guide with their clients to help them make informed decisions on their work and retirement plans.

Read on and find out everything you need to know about the Social Security earnings test.

Everyone who has contributed to the program is eligible to collect Social Security benefits starting at age 62. The full retirement age, however, is between 65 and 67, depending on the year you were born. To calculate how much benefit you’re entitled to, the Social Security Administration (SSA) uses a formula based on your income in your 35 highest earning years. This amount is then indexed for inflation.

If you file before reaching FRA, your monthly payments will be permanently reduced by a set percentage for every month before your full retirement age:

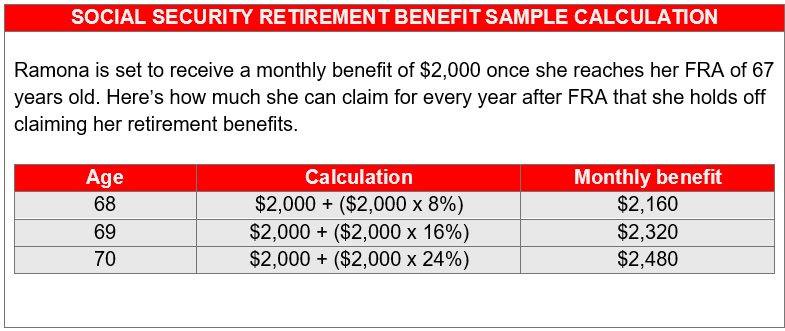

But if you wait until you reach 70 years old before collecting payments, you can earn an additional 8% in benefits for every year after your normal retirement age. This means that if your FRA is 67, you can earn 124% of your monthly retirement benefit by holding off claiming until age 70.

Here’s an illustration.

Learn more about the SSA’s program in this guide to understanding Social Security benefits.

When you claim Social Security benefits before reaching FRA but continue to work, you’re subject to the Social Security earnings test if your income exceeds a certain threshold. The retirement earnings test temporarily withholds or reduces the benefits you receive. The keyword here is “temporary” as you can recoup most of the withheld benefits once you hit full retirement age.

If you’re under FRA for the entire year, the SSA deducts $1 from your retirement benefit for every $2 you earn above the annual income limit. This threshold is also called the lower exempt amount. For 2024, the income threshold is $22,320.

But if you’re reaching full retirement age within the year, the SSA deducts $1 in benefits for every $3 you earn exceeding a different limit, also called the higher exempt amount. This year, the higher limit is $59,520. The agency only counts income up to the month before your FRA and not the entire year.

Let’s look at some examples.

Let’s say you file for Social Security benefits at age 62 in January 2024 and will be receiving $600 monthly or $7,200 for the year. However, you plan to continue working and expect to earn $24,920 in annual income, which is $2,600 above the $22,320 lower exempt amount.

Based on the Social Security earnings test, the SSA will withhold $1,300 of your retirement benefits ($1 for every $2 above the limit). To do this, the department will withhold all your benefit payments from January to March. You only start receiving payments in April.

But if you will notice, the total amount the SSA will withhold is $500 more than $1,300 ($600 x 3 = $1,800) that it’s supposed to. This amount will be added to your retirement benefits the following year.

But let’s say you will be reaching full retirement age in November and expect to earn $63,000 from January to October or $3,480 above the higher exempt amount of $59,520. During this 10-month period, the SSA will withhold $1,160 ($1 for every $3 above the limit) of your retirement benefit.

To do this, the department will withhold the benefit payment for January and February. You will start receiving the $600 benefit in March. The exceeding $40 withheld from your payment will be given to you the following year.

This retirement earnings calculator from the SSA’s website can help give you an estimate of how much Social Security benefits you can receive if you file before FRA.

The special earnings limit rule works for you if you retire mid-year, and your income already exceeds the annual earnings threshold. Under the rule, you can get your full Social Security benefits for the months you’re retired, regardless of how much you earned. This special rule applies to your earnings in a year, usually in the first year of retirement.

If you won’t reach full retirement age in 2024, the SSA will consider you retired if your monthly earnings are $1,860 or lower.

Let’s say you retire at age 62 on October 30, 2024, and your earnings for the first 10 months of the year reach $45,000. Starting November, you take a part-time job with a monthly pay of $500. Although your earnings for the year already exceed the annual limit of $22,320, you will still receive Social Security benefits for November and December. The reason is that your earnings for those months are below $1,860, the monthly limit for those who have yet to reach FRA. The Social Security earnings test limit will only apply to you in the following year.

If you’re self-employed, the SSA will also consider how much work you do. One way is by looking at the time you spend working. In general, the department considers you retired if you work less than 15 hours a month. If you spend between 15 and 45 hours each month in your business doing tasks that require a lot of skill or managing a large business, you won’t be considered retired.

If you’re an employee of a business, only your wages count toward the Social Security earnings limit. The SSA will also consider contributions to your pension or retirement plan as income if they are included in your gross wages.

According to the agency’s guidebook, “income counts when it’s earned, not paid.” This means that your earnings for the year count toward the retirement earnings test, even if you receive the payment the following year. Some examples are the sick leave and vacation pay you accumulate and the bonuses you receive.

If you’re self-employed, the SSA counts only your net earnings. Unlike with salaried employees, your income counts when you get paid and not when you earn it. This rule doesn’t apply if your earnings came before you filed for retirement benefits but received the payment after.

Regardless of whether you’re an employee or self-employed, the following aren’t included the Social Security earnings test:

You can recoup lost Social Security benefits once you hit full retirement age. The SSA recalculates your monthly retirement benefits and adds those withheld before FRA. The credit, however, isn’t paid as a lump sum. Instead, they are paid in increments until they are fully paid.

Let’s say you claim retirement benefits at 62 and receive a monthly payout of $910. Then, you decide to return to work, resulting in you having 12 months of benefits withheld. The SSA will recalculate your benefit at FRA and pay you $975 per month.

If, for example, your earnings significantly exceed the Social Security annual limit between the ages of 62 and 67 that all your benefits during the period are withheld, the department will pay you $1,300 a month starting full retirement age.

Once you reach FRA, there will be no cap on how much you can earn, and your income will have no impact on your Social Security benefit.

The timing of your decision to claim Social Security benefits can have a huge effect on your financial situation come retirement. If you're unsure about your full retirement age and how the Social Security earnings test works, you could lose out on thousands in potential payments.

Under the retirement earnings test, the SSA withholds a portion of your benefits if you continue working and claim benefits before reaching your FRA. These withheld benefits, however, are not permanently forfeited. Once you reach full retirement age, you will either receive a higher monthly payment or additional checks to recover the withheld payments.

Visit our Retirement News Section for more information about Social Security benefits. Be sure to bookmark this page to access breaking news and the latest industry updates.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound