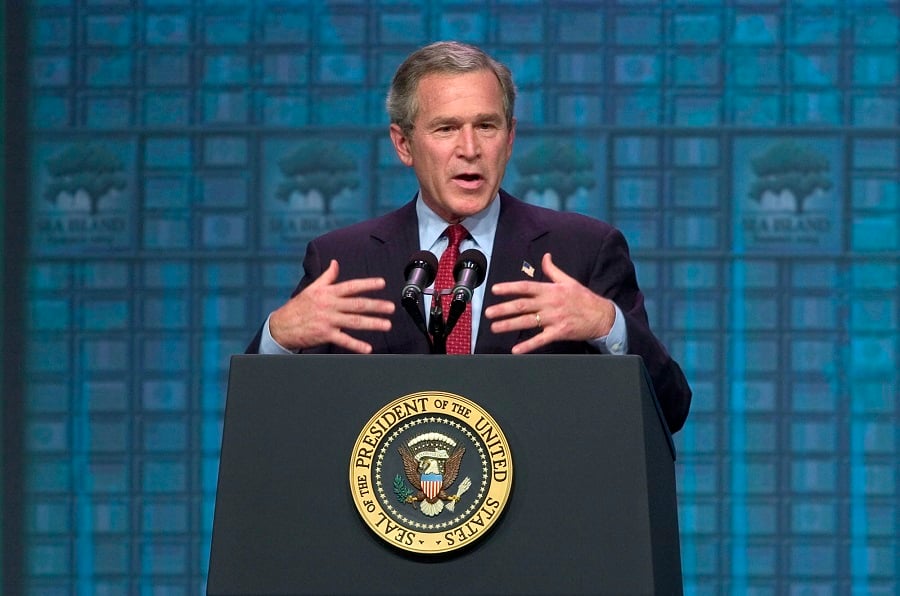

Despite being enthralled in the decision-making moments over the tumultuous times of his presidency, I garnered some helpful insights for anyone in a leadership position. 1. Bad things happen even though we don't want them to. When they do, stay calm but be prepared to say something. The president was sitting reading with a young boy when he was told about the 9/11 attacks. He knew the world was watching. His first instinct was to get up and go deal with the situation. However, he knew excusing himself would rattle the boy, make America look shaken and send the wrong message to the world. Instead, he let the reading end and calmly left the room. Then he reassured his team: “Silence in crisis creates more chaos.” He knew everyone was waiting for him to say something and he was very careful with his words. As leaders of our teams, how often do we instantaneously react when a crisis (or even a challenge) occurs? How measured is our response? Our reaction sets the tone for our team and can have far reaching consequences. (More: Trump adviser Anthony Scaramucci promises to 'repeal' DOL fiduciary rule) 2. Surround yourself with people who know more than you do and whose decisions you trust. During the banking crisis in 2008, he had complete faith in the team around him. While he didn't understand all the intricacies of the system he was asked to bail out, he knew that Henry Paulson and Benjamin Bernanke understood well the consequences of not acting. Depression or recession was the choice. He knew it was an incredibly bad political decision to bail out the banks that were the culprits in the crisis, but he also believed his team was capable of suggesting the most prudent choice. As leaders, it is our job to surround ourselves with good people, but also to empower and trust them when they make recommendations. 3. Ultimately the buck stops somewhere, so you'd better do what you say you are going to do. Whether it was attacking Iraq or bailing out the banks, ultimately he had to make the choice and live with the consequences. However, every major decision rested on doing what he told people he was going to do on behalf of America. In explaining why he invaded Iraq, he described that not following up on his promise to attack Iraq if Saddam Hussein didn't comply with the NATO inspection treaty would embolden every despot around the world to challenge the resolve of the U.S. The President clearly was unhappy about not finding the weapons of mass destruction, however he still feels that other world leaders respected the resolve and might of the U.S. for standing by its words. “If people don't have faith in your follow through, they will have no faith in anything you do,” he said. As leaders, delivering on the promises you make can be the difference between people trusting you and respecting you and the enterprise you represent or not. (More: Hillary Clinton-Donald Trump slugfest could permanently alter US politics: Horizon Investments' political strategist) AND NOW INTO OUR ELECTION This is an incredibly important election, and it's good to know there is collective knowledge and experience from past presidents to give a playbook to the incoming leader. The power of the institution of the presidency and the teamwork that can be assembled with the brightest minds means that a newly elected president has a support network and an operating system to learn from. In this election, both candidates are flawed, but every past president has had his weaknesses too. When asked whom we should all vote for, former President Bush said, "Vote your conscience." The presidency will endure past any one person, and the country will rally around our chosen leader, whomever that may be. It's the American way. Joe Duran is chief executive of United Capital. Follow him @DuranMoney.About to hear former POTUS discuss the elections and consequences. #W #lovemydateof27years pic.twitter.com/wht5eHcNHR

— Joe Duran (@DuranMoney) November 2, 2016

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound