Women’s Equality Day is a time to acknowledge the hurdles faced by women and to honor those who have fought the uphill battle in order to propel women’s rights and recognition forward.

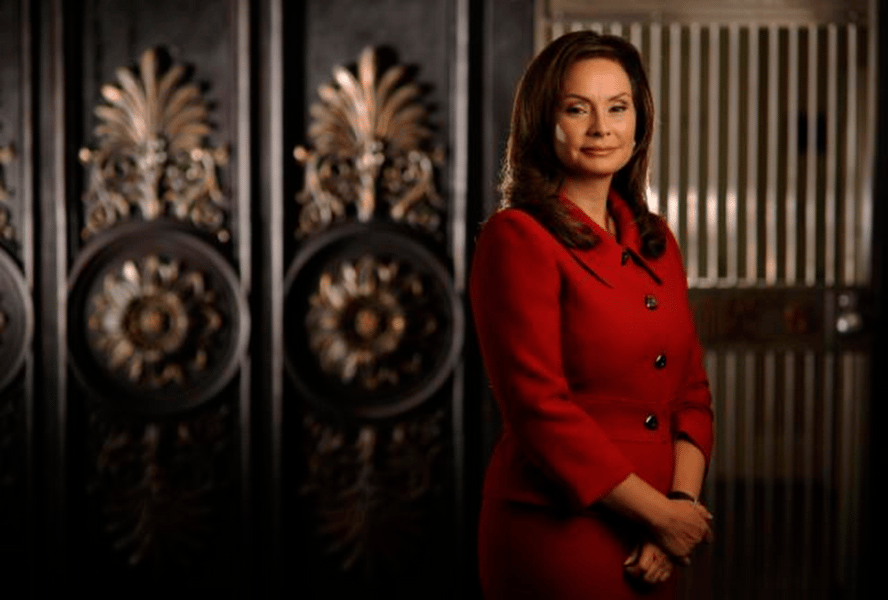

Rosie Rios, the 43rd Treasurer of the United States, is an active example of a leader fighting tooth and nail for women’s equity.

As Treasurer under the Obama Administration, Rosie oversaw all currency and coin production activities with almost 4,000 employees and an annual budget of $5 billion. She initiated the efforts to place a portrait of a woman on U.S. currency and received the Hamilton Award, the U.S. Treasury’s highest honor. Her signature currently appears on a world-record $1.7 trillion.

“People ask me all the time, when are you done?” Rios said in an interview. “I'm done when we’re not talking about this anymore.”

InvestmentNews has captured the trailblazing stories of leading women that have shattered many glass ceilings through its Her Success Matters podcast hosted by CEO Christine Shaw, which is set to relaunch with a fresh lineup of speakers, including Rosie Rios, in September.

What follows is an edited version of Rios' conversation with InvestmentNews.

Nicole Casperson: As the woman that initiated the effort to have Harriet Tubman’s portrait on the $20, where does this historical shift in U.S. currency stand today?

Rosie Rios: It was my inspiration for what I'm working on today in terms of honoring historical American women, but it really goes back to my efforts that started in 2008. At the height of the financial crisis, I was part of the Treasury Federal transition team and so it was during that time in the historical resource center in the Treasury, I came across these renderings and concepts of not just currency, but all the financial products that the Treasury made.

That’s when this “aha” moment came to me. So it's been a work in progress for a long time. It was something that I shepherded through the [Obama] administration, and obviously, the Biden administration today is continuing those efforts.

By law, it's the Secretary of the Treasury who has the final decision making on this effort. It's not the President and it's not Congress. I remain hopeful that this very long journey will come to fruition.

NC: Will you talk to us about how acknowledging important women in history can bridge not just a monetary gap but social disparity?

RR: I truly believe that there is a correlation between visibility and value. So there are two efforts. One is the physical recognition of historical American women, and I have several initiatives that specifically focus on the role that women have played in our history.

The other component that is also equally a priority for me is what I call ‘women, money and power.’

When you think about the pillars of influence: Sex, money and power, unfortunately, women have been relegated to the sandbox of talking about our bodies. Meanwhile, women in positions of influence when it comes to political, social and economic influence remain elusive.

If you look at all the indicators of those areas, [women] tend to flatline at 20%, whether it's a corporate board, C-suites, senators, governors or women in Congress.

By the way, that 20% figure, it's been that way for a long time. When I had asked the Bureau of Engraving and Printing director why we'd never had the portrait of a woman on our Federal Reserve Notes, I asked his deputy the same question, they all had the same answer which is, ‘no one's ever brought it up.’

So a huge oversight when it comes to 51% of our population. To have women as part of our historical narrative is something that we need to see every day in terms of visualizing who participated in our history.

When you don't feel valued, when you don't see yourself in history, or in leadership positions, or in any type of equitable representation, it creates what I call a confidence deficit. That carries over and is compounded over time, if it's not addressed.

That impacts this next generation of leadership and so my new path forward is trying to really address this issue, because I think there's a consciousness in this country when it comes to women. I do think we're overlooked, whether it's deliberate or not, whether it's unconscious bias or not, I do think that there are consequences here.

My theory is, we value what we see everyday, but we see what we value, and this plays an unconscious bias when you don't realize that you're being influenced by something you're exposed to.

So my premise is, could it be that we don't realize that we're being influenced by something we're not exposed to? And the answer is: Absolutely. If you can see it, you can be it. You need those inspirations in order to have aspirations. And I do think that financial, economic correlation, absolutely is one of the consequences because it's 51% of the population, we are all impacted.

NC: How will prioritizing changing attitudes of those in leadership ultimately impact future generations of leaders?

RR: A lot of my champions, people hate when I say this, have been men with daughters. The truth is, if around 80% of the executive decision makers are men, men have to be part of the solution. Otherwise, we will continue on the same treadmill over and over flatlining at this 20% metric.

The only way change happens is when we don't settle. Now, having more women in positions of money and power is not going to be easy to fix, because that is a threat to a lot of people who want to keep it exactly the way it is. The only way that's going to change is when we are all awake. In this particular issue, which again is 51% of the population, the only way that change is going to happen is one male at a time.

New chief executive Rich Steinmeier replaced Dan Arnold on October 1.

The global firm is navigating a crisis of confidence as an SEC and DOJ probe into its Western Asset Management business sparked a historic $37B exodus.

Beyond returns, asset managers have to elevate their relationship with digital applications and a multichannel strategy, says JD Power.

New survey finds varied levels of loyalty to advisors by generation.

Busy day for results, key data give markets concerns.

A great man died recently, but this did not make headlines. In fact, it barely even made the news. Maybe it’s because many have already mourned the departure of his greatest legacy: the 60/40 portfolio.

Discover the award-winning strategies behind Destiny Wealth Partners' client-centric approach.